Loading

Get Guamtax Com

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Guamtax Com online

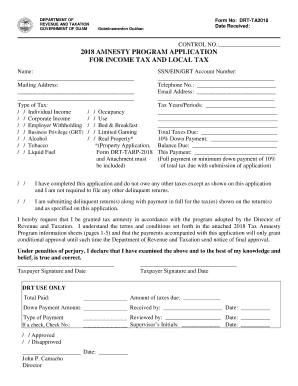

This guide provides a step-by-step approach to completing the Guamtax Com form for the 2018 Amnesty Program application for income tax and local tax. With clear instructions and useful information, users can navigate the online process confidently.

Follow the steps to complete your application efficiently.

- Click ‘Get Form’ button to access the form and open it for completion.

- Enter your name in the designated field. Ensure that your name is spelled correctly as it will appear on any official documents.

- Fill in your mailing address accurately, including street number, city, and any relevant zip codes.

- Select the type of tax you are applying for by checking the appropriate box. Options include individual income, occupancy, corporate income, and others.

- Provide your SSN, EIN, or GRT account number in the specified field to identify your tax records.

- Fill in your telephone number and email address for any potential correspondence regarding your application.

- Indicate the tax years or periods relevant to your application in the given field.

- Enter the total taxes due in the section provided. Ensure that this amount reflects your current tax obligation.

- Calculate and enter the 10% down payment amount based on the total taxes due.

- Complete the balance due field automatically generated based on your inputs.

- Select if you have completed this application and owe no other taxes or if you are submitting delinquent returns along with payment.

- Sign and date the form where indicated. Be aware that your signature confirms the accuracy of the information you've provided under penalties of perjury.

- Finalize your application by saving any changes made. You can choose to download, print, or share the completed form as needed.

Begin filling out your Guamtax Com form online today to take advantage of the tax amnesty program.

More In File An individual who has income from American Samoa, the Commonwealth of the Northern Mariana Islands (CNMI), Guam, Puerto Rico or the U.S. Virgin Islands will usually have to file a tax return with the tax department of one of these territories.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.