Loading

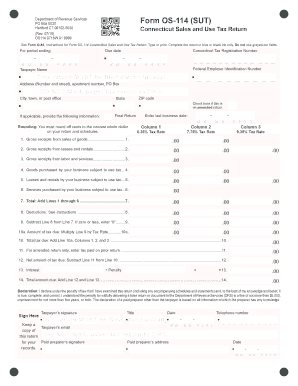

Get See Form O-88, Instructions For Form Os-114 Connecticut Sales And Use Tax Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the See Form O-88, Instructions For Form OS-114 Connecticut Sales And Use Tax Return online

Filling out the See Form O-88 for the Connecticut Sales And Use Tax Return can seem daunting, but with a clear guide, you can complete the process with ease. This user-friendly manual outlines the steps to effectively navigate and fill out the form online, ensuring compliance with state regulations.

Follow the steps to accurately complete your form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Identify the period ending and due date to ensure timely submission.

- Input your Connecticut Tax Registration Number and Federal Employer Identification Number in the designated fields.

- Provide your Taxpayer Name and Address clearly, using blue or black ink only.

- If applicable, indicate if this is an amended return by checking the appropriate box.

- Complete the Gross Receipts section, ensuring accuracy in reporting all sales, leases, and services.

- Carefully add deductions as instructed, ensuring to refer to the guidelines provided in Form O-88.

- Calculate the total tax due by following the addition and subtraction steps outlined, specifically Lines 10a through 12.

- Enter any interest and penalties as applicable, calculating the total amount due.

- Sign and date the form where indicated, and ensure to keep a copy for your records.

- Submit the completed return electronically as the document must be filed online.

Complete your documents online to meet your tax obligations efficiently.

Is there any place I can go to get tax forms? A) Yes, you may visit a local IRS office or a post office or library that carries tax forms. You may also use computers that are often available for use in libraries to access IRS.gov to download needed forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.