Loading

Get Icci Bank Transaction Charge Back Form For Disputed Transactions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ICCI Bank Transaction Charge Back Form For Disputed Transactions online

Filing a chargeback can be a crucial step in resolving disputed transactions. This guide provides a comprehensive and user-friendly approach to filling out the ICCI Bank Transaction Charge Back Form for Disputed Transactions online, ensuring that you have all the necessary information at your fingertips.

Follow the steps to complete the form effectively.

- Press the ‘Get Form’ button to obtain the form and open it in your chosen editor.

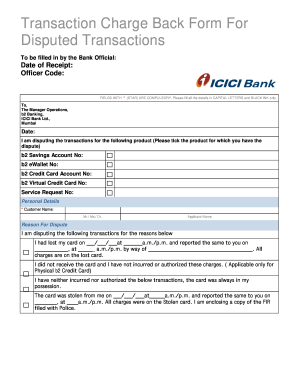

- Enter the date of receipt and the officer code in the designated fields, ensuring accuracy as these are essential for processing.

- Address the form to 'The Manager Operations, b2 Banking, ICICI Bank Ltd., Mumbai' and provide the current date at the top.

- Select the product associated with the disputed transaction by ticking the appropriate box for the following options: b2 Savings Account No, b2 eWallet No, b2 Credit Card Account No, or b2 Virtual Credit Card No.

- Fill in the service request number if applicable and provide your personal details, including your name. Remember to use capital letters and black ink only for clarity.

- Describe the reason for the dispute by selecting the corresponding statement regarding the card loss, non-receipt, unauthorized transactions, or theft. Be specific about dates and times when reporting incidents.

- List the details of the disputed transactions, including the transaction date, merchant name, and transaction amount. Any additional comments can also be added for clarification.

- Ensure that you check the document checklist to confirm that you have attached all necessary documents, such as the FIR copy if applicable and additional declarations.

- Finally, sign the form to certify that the information provided is accurate and authorize the bank to conduct investigations.

- After completing all the sections, you can save changes, download, print, or share the form as required.

Start filling out your documents online today for a smoother process.

If your issuer accepts the dispute, they'll pass it on to the card network, such as Visa, Mastercard, American Express or Discover, and you may receive a temporary account credit. The card network reviews the transaction and either requires your card issuer to pay or sends the dispute to the merchant's acquiring bank.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.