Loading

Get Uca-re-wogm. Universal Credit Application-real Estate

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UCA-RE-WOGM. Universal credit application-real estate online

Filling out the universal credit application for real estate can be a straightforward process when you have the right guidance. This guide provides step-by-step instructions to help you complete the UCA-RE-WOGM form online, ensuring you understand each component clearly.

Follow the steps to successfully complete the application.

- Click ‘Get Form’ button to obtain the form and open it in the editing platform.

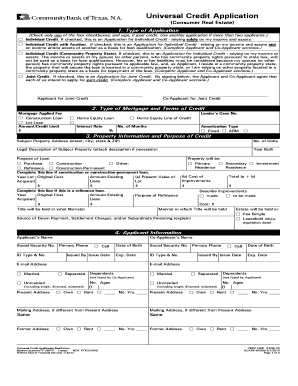

- Begin with the first section titled 'Type of Application.' Here, check only one box that corresponds to your application type: 'Individual Credit,' 'Individual Credit with Another,' 'Individual Credit (Community Property State),' or 'Joint Credit.' Ensure you sign if applying for joint credit.

- Proceed to 'Type of Mortgage and Terms of Credit.' Choose the mortgage type you are applying for, such as 'Construction Loan,' 'Lot Loan,' or 'Home Equity Loan' and specify the amount or credit limit requested.

- Enter the 'Property Information and Purpose of Credit.' Fill in the subject property address, the number of units, legal description, year built, and indicate the purpose of the loan, whether it's for 'Purchase,' 'Construction,' 'Refinance,' or 'Other.'

- In the 'Applicant Information' section, provide the detailed personal information for yourself and any co-applicant. This includes names, social security numbers, primary contact numbers, and current addresses.

- Complete the 'Employment Information' section by providing details about your employment status including the employer's name, address, position, and gross monthly income.

- Input your 'Monthly Income and Combined Housing Expense Information.' Specify all gross monthly incomes for both applicant and co-applicant, as well as combined housing expenses.

- Fill in the 'Assets and Liabilities' section. List all assets, liabilities, and financial obligations, ensuring to detail any additional properties you might own.

- Answer the 'Declarations' questions truthfully regarding any outstanding judgments, bankruptcies, or legal cases that may affect your application.

- Utilize the 'Continuation and Additional Information' section for any additional notes or disclosures as prompted.

- Review the 'Federal Notices' and 'State Notices' sections to understand legal implications and requirements relevant to your application.

- Finally, you will need to sign the 'Acknowledgment and Agreement' section, confirming that the information provided is accurate and that you consent to the terms stated.

- After all sections are completed and reviewed, save your changes, and download, print, or share the completed form as necessary.

Complete your universal credit application for real estate online today to take the next step towards your financial goals.

Most personal loan lenders will require proof of income, even if they don't disclose their minimum income requirements. Only a few lenders, like Upgrade and Universal Credit, offer unsecured loans for a single borrower with no income verification.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.