Loading

Get Anz Tax Residency And Foreign Tax Information

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Anz Tax Residency And Foreign Tax Information online

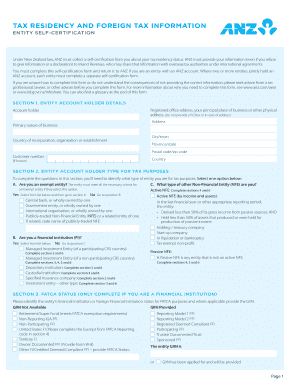

Completing the Anz Tax Residency And Foreign Tax Information form is essential for determining your tax residency status under New Zealand law. This guide will provide you with step-by-step instructions to help you accurately fill out the form online.

Follow the steps to ensure accurate completion of your tax residency form.

- Press the ‘Get Form’ button to obtain the form and open it in the editor.

- In Section 1, provide your entity account holder details, including the primary nature of your business and the registered office address. Ensure that you do not use a PO Box.

- For Section 2, identify your entity type for tax purposes by selecting the appropriate option: exempt entity, financial institution, or other non-financial entity. Complete the relevant subsections based on your selection.

- If applicable, complete Section 3 to provide your FATCA status. Include the GIIN if available or indicate if it has been applied for.

- In Section 4, specify your entity's tax residence(s). Provide details of all countries where you have tax residency, and include Tax Identification Numbers or reasons for not providing them.

- In Section 5, include tax residency information for controlling persons if you selected a passive non-financial entity status. Fill in the necessary details and address information.

- Complete Section 6 by providing your declaration and signatures. Ensure that all provided information is accurate and complete.

- Finally, you can save changes, download, print, or share the completed form as needed.

Complete your Anz Tax Residency And Foreign Tax Information form online to ensure compliance with New Zealand tax laws.

You are a resident of the United States for tax purposes if you meet either the green card test or the substantial presence test for the calendar year (January 1 – December 31). Certain rules exist for determining your residency starting and ending dates.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.