Loading

Get Application-for-small-business-rates-relief-2017-2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Application for small business rates relief 2017-2018 online

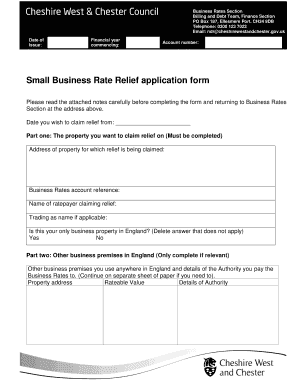

Filling out the Application for small business rates relief can be crucial for eligible businesses to reduce their financial burden. This guide provides clear, step-by-step instructions to help you complete the form accurately and effectively online.

Follow the steps to successfully complete your application.

- Press the ‘Get Form’ button to obtain the application document and open it for editing.

- Fill in the date you wish to claim relief from at the designated section. Make sure it is accurate to avoid delays.

- Complete Part One by providing the address of the property for which relief is being claimed, along with the business rates account reference and the name of the ratepayer. If applicable, include the trading name of your business.

- Respond to the question regarding whether this is your only business property in England by deleting the answer that does not apply and leaving the correct answer.

- Complete Part Two only if you own or occupy other business premises in England. Provide the address and rateable value of these properties, as well as the authority to whom you pay business rates.

- If applicable, fill out Part Three, detailing any changes to occupation of other business properties. Include the property address, rateable value, nature of the change, and the date of that change.

- In Part Four, read the declaration carefully. Sign the application either personally or by someone authorized to do so on your behalf. Ensure that the printed name, role in the business, and contact number are clearly stated.

- Review the entire form for accuracy and completeness before saving your changes. Ensure all relevant parts are filled to avoid processing delays.

- Once satisfied, download, print, or share the completed form as necessary, ensuring to submit it in writing to the Business Rates Section at the provided address.

Begin your application for small business rates relief online today to relieve your financial obligations.

You can find the rateable value of a property on Scottish Assessors Association website. You'll also find a breakdown of how a rateable value was calculated for most properties.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.