Loading

Get Nbrequest Dteenergy Com

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nbrequest Dteenergy Com online

Filling out the Nbrequest Dteenergy Com form is an essential step for users seeking to manage their property transfer tax efficiently. This guide will walk you through each section of the form, providing detailed instructions tailored to your needs.

Follow the steps to complete the form accurately.

- Press the ‘Get Form’ button to obtain the form and open it in the designated editor.

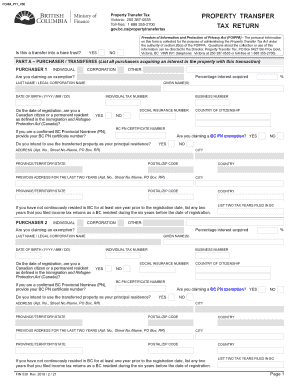

- In Part A – Purchaser / Transferee, list all purchasers acquiring an interest in the property. Provide their given names, last names, and other identifying information such as individual tax numbers and dates of birth.

- Indicate on the form if the purchasers are Canadian citizens or permanent residents as defined in the Immigration and Refugee Protection Act. Include applicable details regarding previous addresses and tax residency.

- In Part B, if the mailing address is different from Part A, enter the contact name and mailing address including city, province, postal code, and country.

- In Part C – Vendor / Transferor Information, provide the details of the vendor, ensuring to confirm their residency status under the Income Tax Act.

- Move on to Part D – Description of Property and Transfer. Fill in the date of the transaction, type of property, transaction type, and parcel identifier number.

- In Part E – Terms, fill out the financial details related to the transaction such as funds, financing, and any other considerations. Calculate the gross purchase price.

- If applicable, complete Part F regarding the allocation of gross purchase price for non-residential properties.

- In Part G – Additional Information, provide information regarding lease terms, charitable registration, and any improvements on the property.

- Proceed to Part H, where relevant proportional principal residence information must be disclosed, including the value of improvements and land.

- Complete Part I for the Property Transfer Tax (PTT) calculation. Declare if this return is for a previously withdrawn transfer and provide necessary values.

- In Part J – Funds Transfer Authorization, confirm your account details, and authorize the transfer of the property transfer tax.

- If applying for the first-time home buyers’ exemption, complete Part K with the relevant declarations from purchasers.

- Finally, finish with Part L – Certification, ensuring that all purchasers sign and date the form to validate its accuracy.

- Once completed, you may save the changes, download the form, print it, or share it as needed.

Complete your Nbrequest Dteenergy Com form online efficiently.

Paying by phone using our automated payment system is a fast, convenient way to pay your DTE Energy bill — 24 hours a day, 7 days a week. Simply call 800.477. 4747. When you pay by phone, you can use Visa®, MasterCard®, Discover®, debit or credit cards, or checking account.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.