Loading

Get Traditional 403(b) Distribution Request

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Traditional 403(b) Distribution Request online

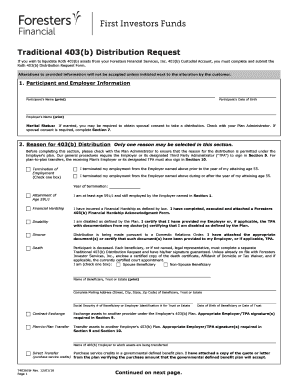

Completing the Traditional 403(b) Distribution Request form online is a straightforward process that allows users to manage their retirement assets efficiently. This guide provides clear, step-by-step instructions to help you fill out this important document correctly.

Follow the steps to successfully complete your distribution request.

- Press the ‘Get Form’ button to access the Traditional 403(b) Distribution Request form and open it for editing.

- Begin by filling out the participant and employer information. Enter your name, date of birth, and the name of your employer. Select your marital status, noting that spousal consent may be needed for certain distributions.

- Indicate the reason for your 403(b) distribution. Only one reason may be chosen. Ensure that the selected reason complies with your employer's plan by confirming with your Plan Administrator.

- Select your distribution options. Choose either the one-time distribution or periodic distribution. For one-time distributions, specify the amount or percentage from your accounts. For periodic distributions, choose a frequency and start date.

- Fill out the payment directions section. Specify how you would like to receive your distribution—through check, electronic funds transfer, or transfer of shares. Provide the necessary details for your chosen payment method.

- Complete the federal tax withholding section by reviewing if withholding is applicable based on your distribution type. Choose any applicable exemptions.

- If married, ensure that the spousal consent section is completed, including the required signatures and witnessing.

- Sign and date the form in the signature section. Review all entries to ensure accuracy.

- If applicable, have the Employer or Third Party Administrator sign in the designated section, ensuring all necessary authorizations.

- Final steps include reviewing the completed form, then saving your changes. You may then download, print, or share the form as needed.

Start filling out your Traditional 403(b) Distribution Request online today for a smooth distribution process.

Current IRS regulations allow withdrawals of 403(b) monies, without penalties, when you: Reach age 59½, Retire or separate from service during the year in which you reach age 55 or later,***

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.