Loading

Get Separately Managed Account Letter Of Direction

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Separately Managed Account Letter Of Direction online

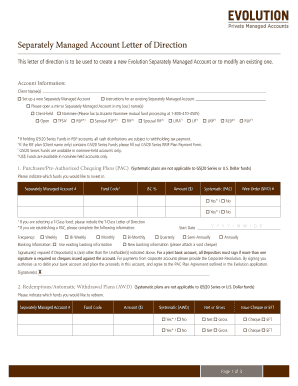

The Separately Managed Account Letter Of Direction is an essential document for establishing or modifying a Separately Managed Account. This guide provides step-by-step instructions to assist you in completing the form online accurately and efficiently.

Follow the steps to fill out your form correctly.

- Press the ‘Get Form’ button to access the Separately Managed Account Letter Of Direction. This action will enable you to download and open the necessary document for editing.

- Begin by filling out the account information section. Indicate the client names and choose one of the options for setting up or modifying an existing Separately Managed Account. Mark the appropriate checkboxes as needed.

- Proceed to specify the account type you are opening or modifying. Select one of the options, including Investor accounts like TFSA, RSP, or RIF, as applicable.

- Outline the purchases or pre-authorized chequing plans. Indicate the funds you wish to invest in by providing the Separately Managed Account number, fund code, percentage, and amount. If applicable, select 'Yes' or 'No' for systematic investments.

- Fill out the redemptions or automatic withdrawal plans information. Specify the funds to redeem, providing the necessary account and amount details. Select your preference for net or gross reddemption.

- Complete any transfer requests between managed accounts. Clearly define the amounts and fund codes for any systematic transfers, marking any relevant options.

- Indicate your investment advisory fee as required, ensuring you fill in any alternative percentages if they differ from the standard IP Group rates.

- Review and acknowledge the authorization section towards the end of the document. This confirms your understanding of the conditions and responsibilities relating to your financial situation.

- Finally, provide your signature(s) and any required details as indicated. Ensure all signatures are collected, especially for joint accounts or corporate accounts.

- Once all fields are completed, save your changes, and choose to download or print the completed form or share it digitally with the necessary parties.

Start filling out your Separately Managed Account Letter Of Direction online today!

However, the biggest difference between the two approaches is that under an SMA client portfolios replicate the overlying model whereas through an IMA every client's portfolio can be different, no two portfolios will be the same.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.