Get Post Office Money Growth Bond - Application Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Post Office Money Growth Bond - Application Form online

Filling out the Post Office Money Growth Bond - Application Form online can seem daunting, but with clear guidance, you can complete it with confidence. This guide will walk you through each section of the form, ensuring that you understand what information is needed.

Follow the steps to successfully complete your application.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

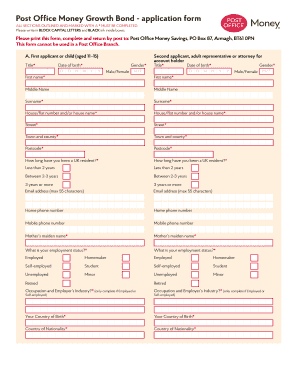

- In section A, provide details for the first applicant or child aged 11-15. Enter the title, date of birth (in DD/MM/YYYY format), and gender. Make sure to complete all fields marked with an asterisk.

- Next, fill out the information for the second applicant or the adult representative, including title, date of birth, first name, middle name (if applicable), surname, and address details.

- Indicate how long you have been a UK resident by selecting the appropriate option. Additionally, provide your email address, home phone number, and mobile phone number.

- State the mother’s maiden name and your employment status. Complete additional fields if you are employed or self-employed, including occupation and employer’s industry.

- In section B, answer questions about your current income and financial situation, ensuring to select all applicable sources of income.

- Specify your savings goal by ticking one appropriate option. For tax purposes, indicate your citizenship status and residency in any non-UK countries.

- In section C, choose the term of the bond and specify the amount of initial deposit. Ensure the amount is within the stated limits of £500 to £1 million.

- Select your method of payment, entering the required account details if paying by a personal cheque or transferring from a Post Office Savings account.

- In section D, provide information on where you heard about the account and enter any promotional codes, if known.

- Review section E for interest payment instructions and provide a nominated account if you prefer to have the interest paid elsewhere.

- In section F, read the declaration carefully, providing your signature and the date. If applying jointly, ensure both applicants sign the declaration.

- Lastly, save your completed form and ensure it is ready for printing. You can download, print, or share the form as needed before sending it to the designated address.

Begin filling out your Post Office Money Growth Bond - Application Form online today to secure your future savings.

Bonds available through Post Office ProductsRateManageGrowth Bond3.60%gross/AER fixed for 1 yearOnline By phone By post Find out more >3.65% gross/AER fixed for 2 years3.70% gross/AER fixed for 3 years Interest is paid annually on the anniversary of the account opening and at maturity3 more rows

Fill Post Office Money Growth Bond - Application Form

Download application form. Common Growth Bond questions. You can select this option on the application form. You can only apply for Guaranteed Growth Bonds online. Downloads. Bonds only - term of Bond (e.g. Opening a Post Office Online Bond. Can I have more than one Post Office Online Bond? By Downloading the Application Form. Step 1: Download and print the relevant application form from the post office's official website.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.