Loading

Get Iatse Annuity Hardship Withdrawal

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Iatse Annuity Hardship Withdrawal online

This guide provides clear and supportive instructions for filling out the Iatse Annuity Hardship Withdrawal form online. By following these steps, users can ensure their submissions are complete and processed efficiently.

Follow the steps to complete your Iatse Annuity Hardship Withdrawal form.

- Click the ‘Get Form’ button to obtain the form and open it in your editor.

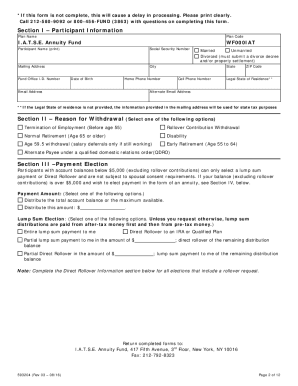

- In Section I, fill out all applicable participant information, including your name, social security number, and contact details.

- Move to Section II where you will place a checkmark next to the reason for the withdrawal. Make sure to select one option only.

- In Section III, indicate the amount of funds you are requesting or check the box for the maximum amount available. Specify your preference for how you would like the distribution to be processed.

- If applicable, complete Section IV if you are choosing an annuity or a rollover. Provide the necessary information as requested.

- Section V allows you to note any additional instructions that may assist in processing your withdrawal.

- In Section VI, make your federal and state income tax withholding elections. This is crucial for ensuring accurate tax processing.

- Choose your payment method in Section VII, selecting either a check or ACH direct deposit.

- You must sign Section VIII as authorization for the withdrawal. This section also confirms your understanding of the provided notices.

- If your balance is over $5,000, complete Section IX regarding the waiver of the joint and survivor annuity, if required.

- Review any instructions specified by the Iatse Annuity Fund representative in Section X and ensure everything aligns with their requirements.

- Finally, ensure all sections are filled correctly, and submit your completed form to the Iatse Annuity Fund office, which may involve returning it either by mail or fax.

Complete your Iatse Annuity Hardship Withdrawal form online today to ensure timely processing of your withdrawal.

(If you're under age 59½ when you make a hardship withdrawal, you may also be subject to a 10% early withdrawal tax penalty on the amount of the withdrawal.) Employer contributions to your Annuity Account and Rollover Account balances are not eligible for hardship withdrawal.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.