Loading

Get Nysdcp

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nysdcp online

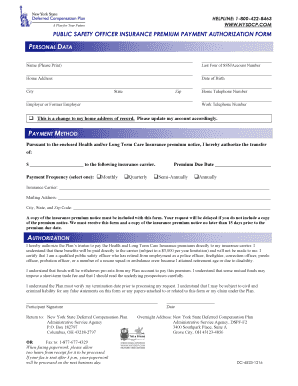

Completing the New York State Deferred Compensation Plan (Nysdcp) online is a straightforward process that allows users to efficiently fill out the Public Safety Officer Insurance Premium Payment Authorization Form. This guide will provide step-by-step instructions to help you navigate the form with ease.

Follow the steps to successfully complete the Nysdcp form.

- Click 'Get Form' button to obtain the form and open it in the editing interface.

- In the personal data section, provide your name, home address, date of birth, city, state, zip code, home telephone number, employer or former employer, work telephone number, and the last four digits of your Social Security number or account number. If this submission is to update your home address, check the corresponding box.

- Next, move to the payment method section. Enter the amount you authorize to be transferred to the insurance carrier. Select your preferred payment frequency (monthly, quarterly, semi-annually, or annually) and provide the premium due date.

- Fill in the insurance carrier's name and mailing address, including city, state, and zip code. Remember to attach a copy of the insurance premium notice as it is essential for timely processing.

- In the authorization section, read through the statements carefully. By signing this section, you confirm your eligibility as a qualified public safety officer, and your understanding of the conditions regarding the payment of premiums and potential civil and criminal liabilities.

- Ensure you sign and date the form at the designated spaces.

- Finally, return the completed form either by mailing it to the provided address or faxing it. If faxing, allow up to two hours for processing; documents sent after 3 p.m. will be processed the following business day. Meantime, you have the option to save changes, download, print, or share the completed form.

Start filling out your Nysdcp document online today for a seamless experience.

Negotiate for fair market value, and defer the difference between what the company agrees you are worth and what they are able to pay today. Fourth, what form will the deferral take? You could take it in cash, stock options, or grants of stock. You don't owe income tax on the deferred amount until you are paid.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.