Loading

Get Wages And Excludible Wages Schedule

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Wages And Excludible Wages Schedule online

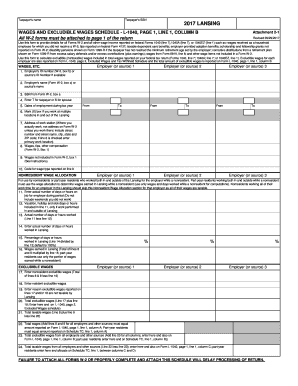

Filling out the Wages And Excludible Wages Schedule is essential for reporting your wage income accurately. This guide will walk you through the process of completing the form online, ensuring that you provide all necessary information for a smooth filing experience.

Follow the steps to complete the form correctly.

- Click ‘Get Form’ button to access the Wages And Excludible Wages Schedule and open it in your preferred document editor.

- Enter the taxpayer's name and Social Security Number (SSN) at the top of the form. This information is crucial for identification purposes.

- List each employer or source of income in the designated sections. Fill in the employer's ID number and name as reported on the W-2 forms.

- Indicate the taxpayer's or spouse's status by entering 'T' for taxpayer or 'S' for spouse in the specified field.

- Provide the dates of employment for each employer. Make sure to clearly indicate start and end dates.

- If working from multiple locations, mark the appropriate box and provide the address of the actual work station.

- Enter the total wages, tips, and other compensation as reported on Form W-2 and any wages not included on the W-2.

- For nonresidents, fill out the Nonresident Wage Allocation section, detailing the days or hours worked for each employer.

- Calculate excludible wages for both nonresidents and residents and provide the necessary explanations for non-taxable amounts.

- Finally, review all entries for accuracy. Save your changes, and consider downloading, printing, or sharing the completed form as needed.

Complete your Wages And Excludible Wages Schedule online to ensure accurate filing.

Federal Tax Codes. FIT = Federal Income Tax. FICA = Federal Social Security. MEDI = Federal Medical.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.