Loading

Get Ir56b

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ir56b online

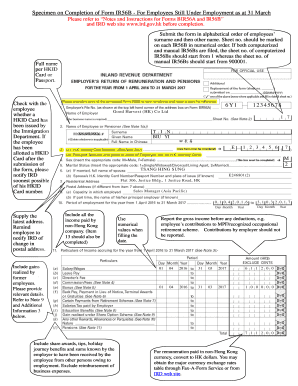

Filling out the Ir56b form online can seem daunting at first, but with a clear understanding of each section, you can complete it efficiently. This guide provides comprehensive, step-by-step instructions to help you navigate the form confidently.

Follow the steps to complete the Ir56b form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the full name of the employee as per their HKID card or passport. It is essential to confirm with the employee if they have been issued an HKID card, ensuring that the number is reported to the IRD promptly if obtained after submission.

- Provide the latest address of the employee. Make sure to remind the employee to notify the IRD of any changes in their postal address.

- Report all income paid by non-Hong Kong companies, ensuring to include gains realized by former employees. Refer to the relevant notes provided in the form.

- Fill out the gross income amount excluding any recognized contributions like MPF. Remember that employer contributions should not be included.

- If there are any benefits such as housing allowance, ensure that they are detailed accurately and indicate '0' for residence location if specified.

- Always complete every item on the form. If a section is not applicable, mark it with '0'.

- Ensure the form is signed by an appropriate authorized individual per the business structure — Proprietor for sole proprietorship, Company Secretary for corporations, etc.

- If there are amendments needed after submission, file a revised Ir56b and ensure to mark the replacement box and fill in the necessary details.

- Once you have filled in all the required information, you can save any changes, download, print, or share the form as needed.

Start filling out your Ir56b form online today for a smoother submission process.

NOTIFICATION. BY AN EMPLOYER OF AN EMPLOYEE WHO IS ABOUT TO DEPART FROM HONG KONG.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.