Loading

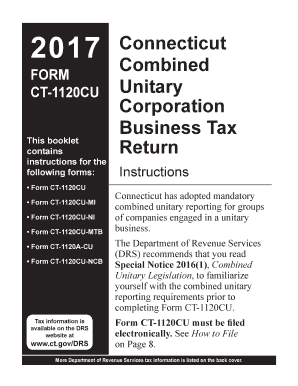

Get Ct 1120cu Instructions 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT 1120CU Instructions 2018 online

Filling out the CT 1120CU Instructions 2018 can be a straightforward process when you follow the right steps. This guide is designed to assist users of all experience levels in completing the form online efficiently and accurately.

Follow the steps to successfully complete your CT 1120CU Instructions 2018 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Provide your combined group's income year by entering the beginning and ending dates on the designated line.

- Enter the designated taxable member's information, including the name, mailing address, Connecticut tax registration number, and federal employer identification number.

- Indicate if this is the first year of filing, the last year, or if it's an amended return by checking the appropriate box.

- Complete Part I by listing the tax on combined group net income and minimum tax base for all taxable members.

- In Part II, calculate the combined group unitary tax credit by entering each member's separate tax liability.

- Fill out the Combined Unitary Group Net Operating Loss Summary if applicable, by entering the total apportioned NOL.

- Complete Part III to compute the amount payable after considering any credits or payments already made.

- Review all information for accuracy, and make any necessary corrections.

- Once satisfied with your entries, you can save changes, download, print, or share the form as needed.

Complete your CT 1120CU Instructions 2018 online today for a seamless filing experience.

The statute of limitations for auditing a Corporation Business Tax return is generally three years, beyond which the Department needs a written consent from the taxpayer.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.