Loading

Get Disclosure Statement Consumer Credit File ... - Lexington Law

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DISCLOSURE STATEMENT Consumer Credit File - Lexington Law online

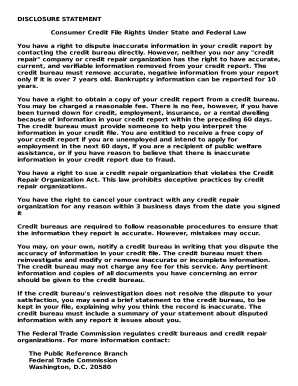

This guide provides clear instructions on how to fill out the DISCLOSURE STATEMENT Consumer Credit File form provided by Lexington Law. Understanding your consumer credit rights is essential, and this guide will help you navigate the process with ease.

Follow the steps to complete the form accurately

- Press the 'Get Form' button to access the form and open it in your preferred document editor.

- In the designated space, enter your full name as it appears on your credit records. Ensure that it is spelled correctly to avoid any discrepancies.

- Fill in the date on which you are completing the form. This is important for record-keeping purposes.

- Review the rights listed in the document regarding disputes and obtain a copy of your credit report. Note any special circumstances under which you may qualify for a free report.

- If applicable, provide any additional information regarding your status, such as if you have been denied credit recently or if you believe there are errors in your credit file.

- Read the acknowledgment section carefully. Confirm that you have received and reviewed the disclosure statement.

- Sign your name in the appropriate space to indicate your understanding and acceptance of the terms outlined in the form.

- Enter the date of your signature below your name.

- Once all fields are completed, save the document to your device. You may also choose to download, print, or share the form as needed.

Complete your documents online with confidence and stay informed about your consumer rights.

A credit score disclosure alerts a consumer about their credit score and other sources of information as required by the Fair Credit Reporting Act (FCRA). The FCRA is a U.S. government legislation that aims to protect consumer information that is collected by consumer reporting agencies or credit bureaus. Contents.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.