Loading

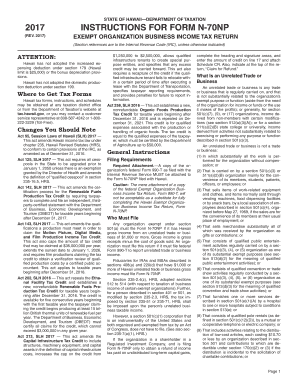

Get Form N-70np Instructions, Rev. 2017, Instructions For Form N-70np Exempt Organization Business

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

*How to use or fill out the Form N-70NP Instructions, Rev. 2017, Instructions For Form N-70NP Exempt Organization Business online*

This guide provides a clear and supportive approach for users seeking to fill out Form N-70NP Instructions, Rev. 2017, which is essential for exempt organizations in Hawaii. Follow these steps to ensure accurate and complete submission of your organization’s business income tax return.

Follow the steps to fill out the Form N-70NP online.

- Click ‘Get Form’ button to obtain the form and open it in your editor.

- Review the general instructions carefully. Ensure that you understand the filing requirements, including the need for attachment of federal Form 990-T, if applicable.

- Determine who must file by confirming your organization's exemption status under section 501(a) and identifying any unrelated trade or business income.

- Fill out the organization's identification details: complete the name, mailing address, and Federal Employer Identification Number (FEIN) in the heading section of the form.

- Complete Block B by entering the applicable unrelated business activity code(s) that best describe your organization's activities.

- Proceed to report the income and deductions from your federal Form 990-T on lines 1 to 7 as instructed, noting any capital gains or taxable amounts.

- Calculate any tax due using the tax rates specified in the instructions, ensuring accurate figures are reported based on the calculations outlined in the tax computation section.

- Attach any necessary forms, schedules, or supporting documentation before submitting your return, including Schedule CR for any tax credits claimed.

- Ensure your return is signed and dated as required, and submit it to the appropriate address based on whether you are including payment.

- After submission, keep the confirmation and any receipts for your records. You can also check back for any updates or correspondence regarding your submission.

- Finalize the process by ensuring compliance with any follow-up actions related to tax filing requirements, including estimated tax payments if applicable.

Begin filling out your Form N-70NP online today to ensure timely and accurate submission!

How to File an Amended Hawaii Return. If you need to correct or amend an accepted Hawaii State Income Tax Return for the current or previous Tax Year, you need to complete Form N-11 (residents), Form N-15 (nonresidents and part-year residents) and Schedule AMD. Forms N-11 and N-15 are Forms used for the Tax Amendment.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.