Loading

Get Minimum Filing Requirements

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Minimum Filing Requirements online

This guide provides step-by-step instructions for completing the Minimum Filing Requirements essential for filing a Chapter 7 bankruptcy petition. Understanding each component will help ensure your submission is accurate and complete.

Follow the steps to successfully fill out your Minimum Filing Requirements.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

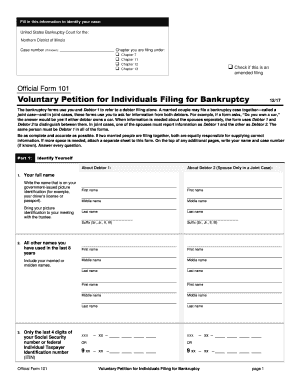

- Complete the Voluntary Petition for Individuals Filing for Bankruptcy (Official Form 101) by providing your full name and any other names used in the last 8 years.

- Fill in the last four digits of your Social Security number or Individual Taxpayer Identification number (ITIN).

- List the names and addresses of all creditors. This is required to be submitted with your petition.

- Select your payment method by indicating if you will pay the filing fee in full, applying to pay in installments (using Official Form 103A), or requesting to have the fee waived (using Official Form 103B).

- Make sure to include the Certificate of Credit Counseling requirement documentation, if applicable, along with the application, if any exemptions are needed.

- Review all information for accuracy and completeness.

- Sign all pages that require a signature, ensuring to include the date of execution.

- Once completed, save changes, and proceed to download, print, or share the form as necessary.

Complete and submit your Minimum Filing Requirements online to ensure your bankruptcy petition is processed efficiently.

Tax Year 2022 Filing Thresholds by Filing Status Filing StatusTaxpayer age at the end of 2022A taxpayer must file a return if their gross income was at least:singleunder 65$12,950single65 or older$14,700head of householdunder 65$19,400head of household65 or older$21,1506 more rows

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.