Loading

Get Return Of Organization Exempt From Income Tax - Heluna Health

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Return Of Organization Exempt From Income Tax - Heluna Health online

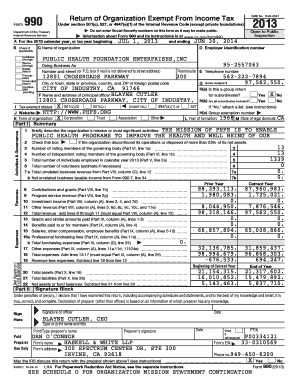

Filling out the Return Of Organization Exempt From Income Tax form, also known as Form 990, can be straightforward with the right guidance. This comprehensive guide will take you step-by-step through each section and field of the form to ensure accurate and complete submission.

Follow the steps to successfully complete the Return Of Organization Exempt From Income Tax online.

- Use the ‘Get Form’ button to access the Return Of Organization Exempt From Income Tax form. This will open the document in a ready-to-fill format.

- Enter the organization’s name, address, and employer identification number (EIN) in the designated fields at the top of the form. Be sure to verify that the provided information is accurate.

- Indicate the tax year for which you are filing the return. This should align with the fiscal year end date of your organization.

- Complete the section regarding the organization's tax-exempt status by checking the appropriate boxes that apply (e.g., 501(c)(3)).

- In Part I, summarize the organization’s mission and significant activities. Provide a brief description that captures the essence and purpose of your organization.

- Continue to Part IX and provide details regarding expenses and revenues. Make sure to categorize each entry correctly—for instance, distinguish between program service revenue and contributions.

- Verify and fill out any relevant sections related to governance, management, and disclosure in Part VI. Make sure all questions are answered accurately.

- Ensure that all financial statements are prepared correctly. If applicable, attach any required supporting schedules or supplementary information.

- Review the entire document for completeness and accuracy. Pay close attention to any sections that require additional explanations in Schedule O.

- Once satisfied with the completed form, utilize the options to save your changes, download, print, or share the form as needed. Ensure you keep a copy for your records.

Complete your Return Of Organization Exempt From Income Tax today to maintain compliance and support your organization’s mission.

Form 990, Return of Organization Exempt From Income Tax An organization must file Form 990, if it is: An organization with either: ► gross receipts of $200,000 or more, or ► total assets of $500,000 or more. A sponsoring organization of one or more donor-advised funds.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.