Get Ca 1422-cfll Isntructions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA 1422-CFLL Instructions online

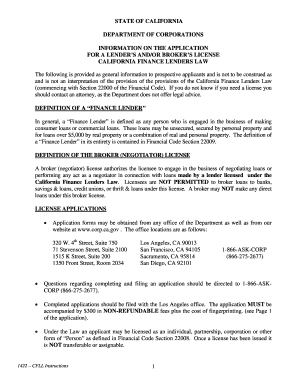

The CA 1422-CFLL Instructions provide essential guidance for applicants seeking a lender’s or broker’s license under the California Finance Lenders Law. This guide offers a clear, step-by-step approach to completing the form online, making the application process more manageable for all users.

Follow the steps to complete the application online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- On the cover page of the application, clearly check only one box to indicate the type of license you are applying for - either 'Lender', 'Broker', or 'Both'. Do not select more than one option.

- In Item Number 1, provide the legal name of the applicant. For individuals, include the first, middle (if applicable), and last name. If you do not have a middle name, indicate so as 'John [no middle name] Smith'.

- If you will be conducting business under a fictitious name, list it in Item Number 1.b. Ensure that it matches exactly with the Fictitious Business Name Statement filed with your county.

- For Item Number 2, indicate the organizational form of your business by selecting the appropriate box such as individual, partnership, or corporation.

- In Item Number 3, provide the full proposed licensed place of business, including the street number and name, city, county, state, and zip code.

- If you are a sole proprietor, complete Item Number 4 by providing your full name and details about the persons in charge of the business.

- For partnerships, complete Item Number 5 with details about the organization, general partners, and those in charge of the business.

- For corporations or other business entities, fill out Item Number 6, providing the names of officers, directors, and those responsible for the business.

- In Item Number 7, disclose any regulatory or other actions taken against you, if applicable.

- Conclude by compiling all required exhibits, completing the Execution Section, and ensuring all necessary signatures are included.

- Once the form is completed, you can save changes, download, print, or share the application as necessary.

We encourage you to complete your CA 1422-CFLL application online to ensure a smooth application process.

The business code for form 3514 can be found on the back of the form itself or in the associated instructions provided by the IRS. This code is important to accurately complete your tax obligations related to the California Earned Income Tax Credit. If you encounter difficulties, remember that the CA 1422-CFLL Instructions are a valuable resource to reference.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.