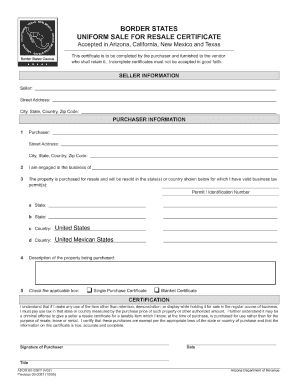

Get Az Ador 60-0081f 2003-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign AZ ADOR 60-0081f online

How to fill out and sign AZ ADOR 60-0081f online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Discover all the primary advantages of completing and submitting legal documents through the internet.

With our platform, filling out AZ ADOR 60-0081f will only take a few minutes. We make that possible by providing access to our feature-rich editor that can modify/correct the original text of a document, insert custom boxes, and enable e-signing.

Submit the completed AZ ADOR 60-0081f in digital format as soon as you finish filling it out. Your information is well-protected, as we adhere to the latest security standards. Join millions of satisfied clients who are already completing legal documents right from their homes.

- Select the document template you require from our array of legal form samples.

- Click on the Get form button to open it and begin editing.

- Fill in the required fields (these will be highlighted in yellow).

- The Signature Wizard will assist you in placing your e-signature once you’ve finished entering your information.

- Add the relevant date.

- Review the entire form to ensure you’ve completed everything and that no amendments are necessary.

- Hit Done and download the completed document to your computer.

How to Adjust Get AZ ADOR 60-0081f 2003: Personalize Forms Online

Eliminate the chaos from your document routine. Uncover the most efficient way to locate, modify, and submit a Get AZ ADOR 60-0081f 2003.

The task of preparing Get AZ ADOR 60-0081f 2003 demands accuracy and concentration, particularly for individuals who are not very acquainted with this type of work. It is crucial to acquire an appropriate template and complete it with the accurate details. With the right approach to managing paperwork, you can have all the tools accessible. It's straightforward to streamline your editing process without acquiring new skills. Locate the appropriate example of Get AZ ADOR 60-0081f 2003 and complete it immediately without toggling between your web pages. Explore additional tools to tailor your Get AZ ADOR 60-0081f 2003 form in the editing mode.

While on the Get AZ ADOR 60-0081f 2003 page, click on the Access form button to begin modifying it. Enter your details into the form on the spot, as all required tools are right here. The example is pre-formatted, so the effort required from the user is minimal. Just utilize the interactive fillable sections in the editor to effortlessly finish your documents. Simply click on the form and move to the editing mode right away. Complete the interactive section, and your file is ready.

Experiment with additional tools to personalize your form:

Often, a minor mistake can spoil the entire form when someone fills it out by hand. Bid farewell to errors in your paperwork. Quickly find the samples you need and complete them electronically through an advanced editing solution.

- Insert more text around the document if necessary. Use the Text and Text Box tools to add text in a separate box.

- Introduce pre-made visual elements such as Circle, Cross, and Check using the corresponding tools.

- If required, capture or upload pictures to the document with the Image tool.

- If you need to draw something in the document, utilize Line, Arrow, and Draw tools.

- Utilize the Highlight, Erase, and Blackout tools to modify the text in the document.

- If you need to attach comments to specific parts of the document, click on the Sticky tool and place a note where desired.

In North Carolina, sales tax exemption typically applies to nonprofit organizations, certain educational institutions, and governmental purchases. However, specific qualifications can vary, so reviewing regulations is crucial. For a clear understanding of how AZ ADOR 60-0081f applies, uslegalforms can provide the information you need.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.