Get Ar Filing Instruction For Llcs & Professional Llcs 2011-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AR Filing Instruction for LLCs & Professional LLCs online

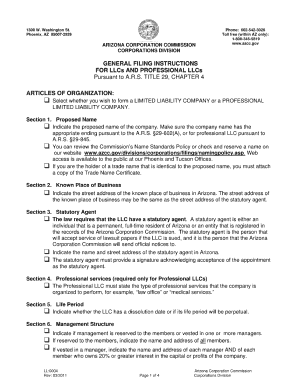

Filling out the AR Filing Instruction for LLCs and Professional LLCs is an essential step in maintaining compliance with state regulations. This guide will walk you through each section of the form, ensuring that you have all the necessary information and guidance to complete the filing accurately.

Follow the steps to complete the filing instruction form online.

- Click ‘Get Form’ button to obtain the document and open it in your preferred editor.

- Begin by entering the name of your LLC or Professional LLC in the designated field. Ensure the name matches the one registered with the state.

- Proceed to complete the section regarding the address of the principal office. Provide a complete street address, including the city and state.

- Specify the nature of your business in the 'Business Purpose' section. Be concise but descriptive to give a clear picture of your operations.

- In the 'Registered Agent' section, provide the name and address of the individual or entity authorized to receive legal documents on behalf of your LLC or Professional LLC.

- Review the section for member or manager information. List all members or managers, including their addresses and roles within the company.

- Finish the form by completing any additional sections as required, such as signatures or dates. Ensure all information provided is accurate.

- Once you have filled in all necessary fields, you can save changes, download the form for your records, print it for mailing, or share it as needed.

Start filling out your AR Filing Instruction for LLCs & Professional LLCs online today.

The new reporting rules for LLCs involve specific disclosures about members and capital contributions, aimed at increasing transparency. LLCs are now required to provide detailed information regarding their tax obligations and ownership stakes. As you navigate these new rules, it’s vital to follow the AR Filing Instruction for LLCs & Professional LLCs carefully. Engaging with uslegalforms will help simplify the compliance process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.