Loading

Get Ny Ls 52 2009-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY LS 52 online

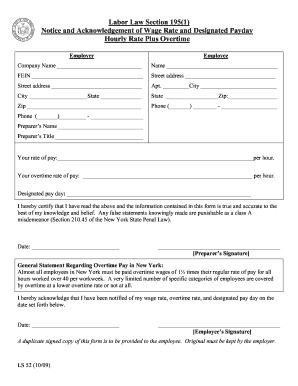

The NY LS 52 form is a critical document related to wage rates and designated paydays in New York. This guide will walk you through the necessary steps to complete the form accurately and efficiently online.

Follow the steps to fill out the NY LS 52 online effectively.

- Press the ‘Get Form’ button to access the NY LS 52 form and open it in your preferred online document editor.

- Begin by entering the employer's information in the designated sections, including the company name, FEIN, and street address details.

- Next, input the employee's information, such as their name, phone number, and address. Ensure that all data is correct to avoid any issues.

- Record the hourly rate of pay and the overtime rate of pay for the employee. Be precise in the amounts recorded, as these figures are important for compliance.

- Indicate the designated pay day. This is the scheduled date on which the employee can expect to be paid.

- Instruct the preparer to review the information entered and certify its accuracy by signing in the respective section, along with the date.

- The employee must then acknowledge receipt by signing the form, also including the date, confirming they understand their wage information.

- Finally, ensure that a duplicate signed copy of the completed form is provided to the employee, while the original should be retained by the employer.

Complete your documents online swiftly and efficiently.

The New York State Wage Theft Protection Act protects workers from wage theft by requiring employers to provide written notices about wages and subsequent changes. This act ensures employees understand their earnings and rights, a critical aspect addressed in NY LS 52. By adhering to this legislation, employers foster a trustworthy workplace environment essential for maintaining employee morale.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.