Loading

Get Nv Form D-8 2010-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NV Form D-8 online

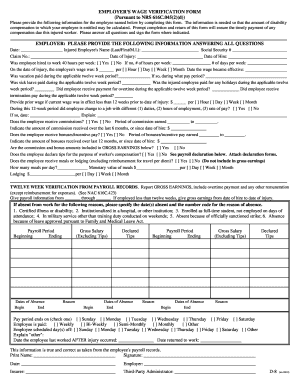

Filling out the NV Form D-8 online requires careful attention to detail. This guide provides clear and concise instructions to assist you in completing each section of the form effectively and accurately.

Follow the steps to complete the NV Form D-8 online

- Press the ‘Get Form’ button to access the NV Form D-8 and open it in your preferred online editor.

- Begin by inputting the date at the top of the form. This helps to establish the timeline of the wage verification process.

- Enter the injured employee’s name in the format of last name, first name, and middle initial in the designated field.

- Provide the employee’s Social Security number in the corresponding field to ensure accurate processing.

- Input the date of the injury, ensuring to use a full date format for clarity.

- Record the date of hire for the employee, which is essential for establishing their employment history.

- Fill in the claim number related to the injury, as this links the form to the specific case.

- Indicate the number of days the employee works each week in the appropriate section.

- Specify if the employee was hired to work 40 hours per week by selecting 'Yes' or 'No.' If 'No,' indicate the number of hours worked per week, and specify whether it's per hour, day, week, or month.

- Input the date when the employee's wage became effective.

- Record the wage amount the employee was receiving on the date of injury.

- Provide details about the pay period during which this wage was applicable.

- Answer questions regarding paid vacation, sick leave, and holiday compensation during the relevant twelve-week period by marking 'Yes' or 'No.'

- Specify if the employee received any overtime payment and termination pay within the applicable twelve weeks.

- If the employee's current wage was effective for less than twelve weeks, enter their prior wage. Make sure to clarify whether this wage was in effect during this period.

- Indicate if there were any changes to the employee's job involving (1) duties, (2) hours of employment, or (3) rate of pay, and provide explanations if necessary.

- Indicate whether the employee receives commissions or bonuses/incentive pay, and provide the relevant details and amounts.

- Fill out the sections regarding meals, lodging, and any other compensation for the employee. Provide monetary values and frequency.

- Complete the twelve-week verification from payroll records, including gross earnings and any absences, specifying reasons and dates where applicable.

- Finally, ensure all the information is complete and accurate, then provide your signature, print your name, and enter the date before submitting the form.

- After completing the form, you can save changes, download a copy, print it, or share it as per your requirements.

Begin filling out the NV Form D-8 online today to ensure timely processing of your employee's compensation.

The Americans with Disabilities Act (ADA) impacts Workers' Compensation claims by ensuring that employees receive fair treatment when filing because of a disability. Employers must provide necessary accommodations which might relate to their Workers' Comp cases. Understanding how to navigate these intertwining laws can be supported effectively through resources like the NV Form D-8.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.