Loading

Get Ca Pers-bsd-369-d 2014-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA PERS-BSD-369-D online

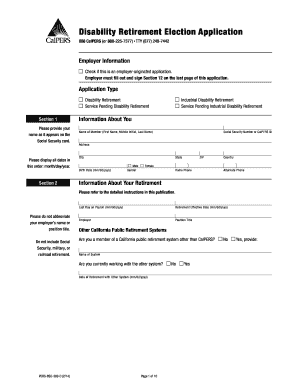

This guide provides a comprehensive overview of how to fill out the CA PERS-BSD-369-D form online. Designed to assist users, this step-by-step guide will help you navigate each section of the application effectively.

Follow the steps to complete your application successfully.

- Press the ‘Get Form’ button to access the CA PERS-BSD-369-D form. This will allow you to open the document in an appropriate editor for further completion.

- Begin with the 'Employer Information' section. If this is an employer-originated application, check the corresponding box. Ensure your employer fills out and signs Section 12 located on the last page.

- In the 'Application Type' section, select the type of disability retirement for which you are applying by checking the relevant box.

- Proceed to Section 1. Enter your full name as it appears on your Social Security card. Please ensure that all dates are formatted as month/day/year.

- Complete Section 2 by providing personal details, including your address, date of birth, and gender. Provide a valid Social Security Number or CalPERS ID and include your contact information.

- In Section 3, describe your specific disability and provide details regarding when and how it occurred. Answer questions regarding your limitations and how they affect your job performance.

- For Section 4, only complete it if a third party caused your injury by checking 'Yes' and providing the necessary details about your treating physician.

- In Section 5, select your retirement payment option and designate your beneficiaries as per your chosen option. Ensure you complete any additional required subsections as indicated.

- Fill out Section 6 to designate recipients for your lump sum Retired Death Benefit, ensuring you provide necessary personal details for each beneficiary.

- Answer the questions in Section 7 regarding your marital and family status to complete your Survivor Continuance details.

- In Section 9, choose your tax withholding preferences for federal and state taxes, following instructions on how to specify your allowances.

- Complete Section 11 by providing your signature and any necessary partner signatures. Ensure all signatures are notarized or witnessed by an authorized representative.

- Finally, review your completed form for any missing information and errors. You can save changes, download, print, or share the form as needed.

Start completing your CA PERS-BSD-369-D form online today!

The California state deferred compensation plan is a retirement savings program designed to help employees save for retirement on a tax-deferred basis. It allows participants to set aside a portion of their salary to invest in a variety of vehicles, increasing their financial security for the future. This plan complements other retirement benefits, ensuring a more robust financial strategy. For a deeper dive into this program, look into CA PERS-BSD-369-D.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.