Loading

Get Ca Edd De 3hw 2010-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA EDD DE 3HW online

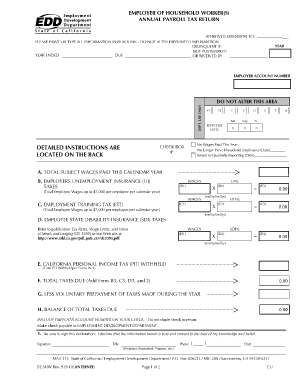

Filling out the CA EDD DE 3HW form online can be a straightforward process with the right guidance. This guide provides step-by-step instructions to help you accurately complete the form for your household workers' annual payroll tax return.

Follow the steps to successfully complete the CA EDD DE 3HW form online.

- Press the ‘Get Form’ button to retrieve the CA EDD DE 3HW form and open it in your browser for editing.

- Begin by filling out the employer account number at the top of the form, ensuring it is accurate and legible.

- Indicate the effective date by entering the month, day, and year when the form is completed.

- Check the appropriate box if you did not pay wages this year or if you no longer have household employees.

- In line A, provide the total subject wages paid to household workers this calendar year.

- For line B, enter the total wages subject to Unemployment Insurance (UI). For box B2, enter the applicable UI tax rate, and calculate tax due in box B3 by multiplying B1 and B2.

- Complete line C for Employment Training Tax (ETT) in the same way as line B: enter total ETT wages in box C1, the tax rate in box C2, and compute ETT due in box C3.

- In line D, record the total State Disability Insurance (SDI) wages in box D1, the SDI tax rate in D2, and calculate the total SDI taxes due in D3.

- For line E, if you voluntarily withheld California Personal Income Tax (PIT), enter the total withholding amount from employee W-2 forms.

- Add the totals from boxes B3, C3, D3, and E to find the total taxes due and fill this in line F.

- If you made any voluntary prepayment of taxes during the year, record the total on line G.

- Calculate the balance of total taxes due by subtracting line G from line F and record that in line H.

- Finally, sign and date the form, providing a phone number for any follow-up regarding the information submitted.

Complete your CA EDD DE 3HW form online to ensure compliance without delay.

The DE 4 and W 4 forms serve different purposes in tax withholding. The DE 4 is specific to California and pertains to state income tax withholding, while the W 4 is federal and relates to federal income taxes. It's essential to fill out both correctly to ensure accurate withholding for your specific circumstances. For assistance in completing these forms, consider services like USLegalForms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.