Get Ut Statment Functional Expense

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UT Statement Functional Expense online

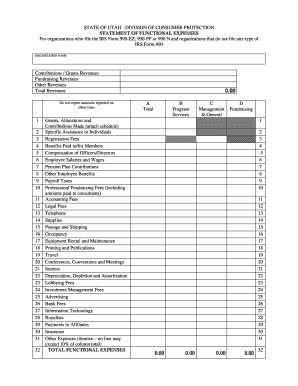

The UT Statement Functional Expense is a vital document for organizations that file IRS Forms 990-EZ, 990-PF, or 990-N, as well as those not filing any IRS Form 990. This guide provides a comprehensive overview and step-by-step instructions to assist you in accurately completing this form online.

Follow the steps to effectively complete the UT Statement Functional Expense online.

- Click the ‘Get Form’ button to obtain the UT Statement Functional Expense form and open it in your preferred editing format.

- Begin by entering the organization name at the top of the form. Ensure the name is spelled correctly, as this will be used in all future documentation.

- Proceed to the contributions/grants revenues section. Input the total revenue amounts from contributions and grants, ensuring that you do not report any amounts that are duplicated in other sections of the form.

- In the fundraising revenues section, provide the total amounts raised through fundraising efforts.

- Next, fill in any other revenues your organization has received, labeling each source accurately.

- Move on to the grants, allocations, and contributions made section. Attach a detailed schedule that outlines specific amounts and recipients.

- Document any specific assistance provided to individuals, as well as registration fees your organization has collected.

- Enter the total benefits paid to or for members of your organization.

- Detail the compensation for officers and directors, as well as employee salaries and wages in the respective sections.

- Include pension plan contributions, other employee benefits, and the payroll taxes your organization has incurred.

- Specify professional fundraising fees and accounting and legal fees your organization has paid.

- Provide information on telephone expenses and the cost of supplies needed for operations.

- Input postage and shipping costs, along with occupancy expenses related to your organization’s physical locations.

- Document costs associated with equipment rental and maintenance, as well as printing and publication expenses.

- Include travel expenses, as well as costs related to conferences, conventions, and meetings.

- In addition, list any interest, depreciation, depletion, and amortization expenses.

- Record lobbying fees, investment management fees, and any advertising costs.

- Detail bank fees, information technology costs, and royalties paid.

- Finally, enter any payments made to affiliates and information on insurance expenses.

- Document any other expenses, ensuring that no line item exceeds 10% of the total column amount.

- At the bottom of the form, ensure that the total functional expenses are accurately calculated.

- After completing the form, verify all entries for accuracy before saving your changes.

- Once verified, you can download, print, or share the form as necessary.

Complete the UT Statement Functional Expense online today to ensure compliance and accurate reporting.

The three categories of functional expenses typically include program services, management, and fundraising. Program services reflect costs directly related to delivering services, while management covers expenses for administrative tasks. Fundraising expenses help organizations track costs associated with raising awareness and securing donations, making the UT Statement Functional Expense an essential tool for financial reporting and strategic planning.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.