Loading

Get Form N 200v

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form N 200v online

This guide provides clear, step-by-step instructions for users on how to complete the Form N 200v online. Whether you are familiar with tax forms or not, this guide aims to simplify the process for everyone.

Follow the steps to complete your Form N 200v online successfully.

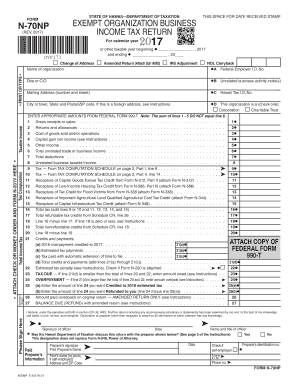

- Press the ‘Get Form’ button to acquire the form and open it for editing.

- In the first section, input the name of your organization in the designated field. It is important to type or print this information clearly.

- Select the appropriate box if this is a change of address, amended return, IRS adjustment, or NOL carryback. Fill in the relevant fields accordingly.

- Enter the Federal Employer Identification Number (E.I. No.) in the specified area.

- Provide the mailing address for your organization. Ensure that it includes the complete street address, city or town, state, and ZIP code.

- Check the box indicating the type of organization: Corporation or Charitable Trust.

- Fill out the income section by entering the appropriate amounts from the Federal Form 990-T. Carefully follow the format required for gross receipts, returns, cost of goods sold, and other income.

- Complete the tax computation schedule. Calculate total deductions, unrelated business taxable income, and total tax due, as indicated.

- Sign and date the form at the bottom, confirming that the information provided is accurate to the best of your knowledge.

- Review the completed form for accuracy, then save any changes you have made. You can also download, print, or share the form as required.

Begin filling out the Form N 200v online today to ensure timely submission.

If you don't pay your tax bill in full by the filing deadline (April 18, 2023, this year), the IRS will charge interest on whatever amount is outstanding. The IRS may also sock you with a late-payment penalty of 0.5% per month, with a maximum penalty of 25% of your unpaid taxes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.