Loading

Get Schedule Sa Instructions (il-1040) - Illinois Department Of Revenue

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Schedule SA Instructions (IL-1040) - Illinois Department Of Revenue online

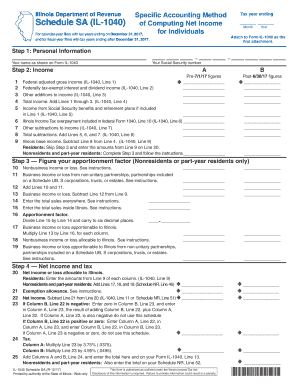

Filling out the Schedule SA Instructions (IL-1040) is an essential step for Illinois taxpayers who need to compute their net income accurately. This guide provides a detailed, user-friendly framework to assist you in completing this important form online.

Follow the steps to complete the Schedule SA Instructions effectively.

- Click ‘Get Form’ button to obtain the Schedule SA instructions and open it in the editor.

- Begin with Step 1 where you will enter your personal information. Provide your name as it appears on Form IL-1040 and your Social Security number. Ensure all details are accurate to prevent delays.

- Move to Step 2 to report your income. Start by entering your federal adjusted gross income from IL-1040, Line 1. Follow by including federally tax-exempt interest and the other additions to income as listed. Sum these amounts to determine your total income.

- Next, include any income from Social Security benefits if captured under Line 1. Age-dedicated columns are split for figures before and after 6/30/17.

- Continuing on, provide any Illinois Income Tax overpayment shown in federal Form 1040 and any other allowable subtractions from income. Add these subtractions together to finalize your total subtractions.

- Calculate your Illinois base income by subtracting the total subtractions from your total income. Residents can then skip to the final steps, while nonresidents and part-year residents should proceed to Step 3.

- In Step 3, calculate the apportionment factor for nonresidents or part-year residents. Report nonbusiness income and any business income or loss as necessary, noting total sales inside and outside of Illinois.

- Proceed to Step 4 where you will determine your net income and tax. Residents will move directly from the base income, while nonresidents add the corresponding lines of apportionable income.

- Complete your calculations according to the final instructions for exemptions and tax rates as prescribed. Prepare to report the overall tax determined on your Form IL-1040.

Complete your Schedule SA Instructions online today to ensure accurate income reporting and compliance.

The Illinois Department of Revenue (IDOR) is the code department of the Illinois state government that collects state taxes, operates the state lottery, oversees the state's industry, oversees the state's thoroughbred and harness horse racing industries, and regulates the distribution of alcoholic beverages ...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.