Get Ny Char500 2006

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY CHAR500 online

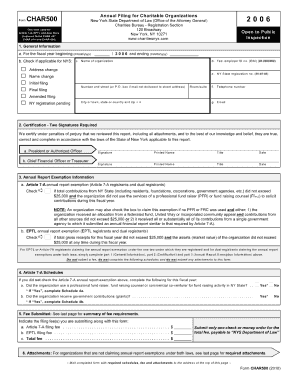

The NY CHAR500 is an essential form for nonprofits in New York State, serving as a financial disclosure document. This guide will provide a clear and supportive approach to filling out the CHAR500 online, ensuring you understand each component.

Follow the steps to complete the NY CHAR500 online effectively.

- Press the ‘Get Form’ button to access the CHAR500 document and open it for entry.

- Begin by entering the basic organizational information. This includes the name of your organization, its address, and the Federal Employer Identification Number (EIN). Ensure accuracy to avoid processing delays.

- Complete the financial information section. This involves disclosing your organization's income, expenses, and net assets. Use precise figures from your financial records to reflect your organization’s true financial status.

- Fill in the governance structure details. Provide information about your board of directors, including names and titles. This section is critical for transparency and compliance with state regulations.

- Address any questions regarding the activities of your organization over the past year. Highlight the programs, services, and challenges faced, contributing to a complete narrative of your nonprofit's impact.

- After completing all sections, review the information for accuracy and completeness. This is a crucial step, as errors may lead to delays in processing.

- Finally, save your changes, download a copy of the completed form, and share it as required. Ensure you have backups and copies for your records.

Complete and submit your NY CHAR500 online today to maintain compliance and transparency for your organization.

Get form

Related links form

The audit report threshold limit is primarily set at $500,000 for organizations required to file the NY CHAR500. When an organization's revenue exceeds this amount, an audited financial report is needed to ensure clear and accurate representation of its operations. Understanding this limit is crucial for charities aiming to maintain compliance and trust. For support with audit report requirements, consider leveraging the resources available on UsLegalForms.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.