Loading

Get 1120s K 1 Codes

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

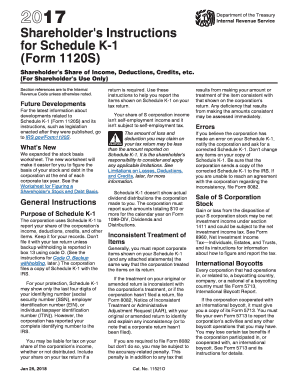

How to fill out the 1120s K-1 Codes online

Filling out the 1120s K-1 Codes form can be a straightforward process when you have clear guidance. This document serves as a comprehensive guide to help you navigate each section of the form with ease.

Follow the steps to complete the form accurately.

- Use the 'Get Form' button to access the form and open it in your editing platform.

- Begin by entering your name and identifying information as required in the header of the form.

- Input details in Box 1 regarding your share of the ordinary business income or loss. Make sure to apply any limitations as needed.

- In Box 2, report any net rental real estate income or loss. Follow the prompts to check if you qualify as a real estate professional.

- Complete Boxes 3 to 9 as applicable, ensuring that each figure corresponds with the relevant sections of your income tax return.

- Move to Box 10 and enter any other income or loss as specified. Refer to the specific codes to ensure accurate reporting.

- Fill out Box 11 for Section 179 deductions, carefully calculating the total, and make sure to follow the related limitations.

- Finish by reviewing all filled sections for accuracy. Save your work frequently, and when complete, you can export, print, or share the form.

Complete your 1120s K-1 Codes form online today for a hassle-free filing experience.

The 1120S Schedule K-1, Box 17, Code K instructions for Dispositions of property with section 179 deductions state the corporation reports the shareholder's pro rata share of gain or loss on the sale, exchange, or other disposition of property for which a section 179 expense deduction was passed through to shareholders ...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.