Loading

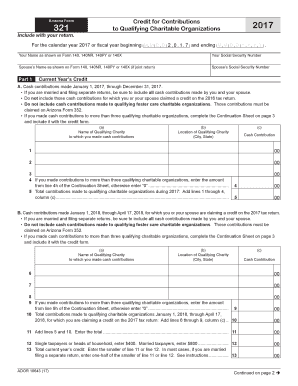

Get Arizona Form 321. Credit For Contributions To Qualifying Charitable Organizations

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Arizona Form 321. Credit for Contributions to Qualifying Charitable Organizations online

Filing Arizona Form 321 allows individuals to claim a credit for their contributions to qualifying charitable organizations. This guide provides straightforward steps to assist users in accurately completing the form online, ensuring a smooth filing process.

Follow the steps to fill out Arizona Form 321 online effectively.

- Press the ‘Get Form’ button to access the form and open it in your editing platform.

- Begin by entering your name as it appears on your Arizona income tax return (Form 140, 140NR, 140PY, or 140X) in the designated field.

- Next, input your Social Security Number in the corresponding section.

- If filing jointly, also include your spouse’s name and Social Security Number as shown on the same tax forms.

- Proceed to Part 1, where you will detail your contributions for the current year. Under section A, enter the cash contributions made from January 1, 2017, to December 31, 2017. Ensure you include all contributions made by both you and your spouse if married and filing separately.

- List each qualifying charity in the columns provided, detailing the name, location (city and state), and cash contribution amount. If contributions exceed three organizations, utilize the Continuation Sheet on page 3.

- Calculate the total contributions made in 2017 by summing the amounts listed in column (c) and entering the total in line 5.

- Complete section B, entering cash contributions made between January 1, 2018, and April 17, 2018 for the credit claim. Follow the same process as in step 6 for this section.

- Add the totals from lines 5 and 10 and enter the sum in line 11.

- For line 12, enter $400 for single taxpayers or heads of households, and $800 for married taxpayers.

- Enter the smaller amount from line 11 or line 12 in line 13, keeping in mind special instructions for those married filing separately.

- Move to Part 2 and document any available credit carryover from prior years. Complete the columns for taxable years, original credit amounts, and amounts previously used.

- Sum the available carryover credits and note the total in line 19.

- Conclude by completing Part 3. Enter the total current year’s credit from line 13 into line 20, and include the available carryover credit from line 19 in line 21.

- Calculate the total available credit by adding lines 20 and 21, and enter the result in line 22.

- Review all entered information for accuracy, then save changes, download, print, or share the completed form as needed.

Begin your journey to completing your Arizona Form 321 online today!

Receive a dollar-for-dollar tax credit on your AZ state return, up to $400 for individuals and $800 when filing jointly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.