Loading

Get Sales And Excise - Sales / Use Tax Forms - Rhode Island Division Of ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sales And Excise - Sales / Use Tax Forms - Rhode Island Division Of ... online

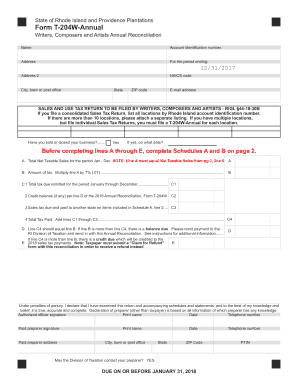

Filling out the Rhode Island Sales And Excise - Sales / Use Tax form can seem challenging, but this guide will help you navigate each section clearly and efficiently. Follow these instructions to ensure your submission is accurate and timely.

Follow the steps to complete your Sales And Excise Tax Form online.

- Click ‘Get Form’ button to obtain the document and open it for filling out.

- Begin by entering your name and the account identification number associated with your business into the appropriate fields.

- Provide your address, including address line 2 if necessary, city, state, and ZIP code.

- Input your e-mail address in the designated field. Ensure it is accurate for any correspondence.

- Indicate the period ending date, which should reflect the reporting period for your tax return.

- If applicable, indicate whether you have sold or closed your business, and provide the date of closure if answered 'Yes'.

- Complete Schedules A and B on page 2 before filling out lines A through E.

- On Schedule A, enter the total net taxable sales for the period in line A, ensuring this equals the amount listed from your calculations.

- Calculate the amount of tax by multiplying line A by 7%. Enter this amount on line B.

- Provide the total tax amounts paid and any credits from previous filings in the subsequent lines.

- Verify that line C4 equals line B to determine if payment is due or if there is an overpayment.

- Complete the certification section, ensuring that an authorized officer signs and dates the form.

- Once all fields are filled out accurately, review the information for completeness.

- After verifying all details, users can save changes, download, print, or share the completed form.

Complete your Sales And Excise - Sales / Use Tax Forms online today for a smooth filing experience.

The sales tax is imposed upon the retailer at the rate of 7% of the gross receipts from taxable sales. In addition to the sales tax, there is also a 6% hotel tax on the rental of rooms in hotels, motels or lodging houses.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.