Loading

Get Simplii Rrsp Withdrawal

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Simplii RRSP Withdrawal online

In this guide, you will learn how to effectively fill out the Simplii RRSP Withdrawal form online. This process is essential for users who want to withdraw funds from their Registered Retirement Savings Plan in a straightforward manner.

Follow the steps to complete your withdrawal request

- Press the ‘Get Form’ button to access the Simplii RRSP Withdrawal form and open it in your preferred editor.

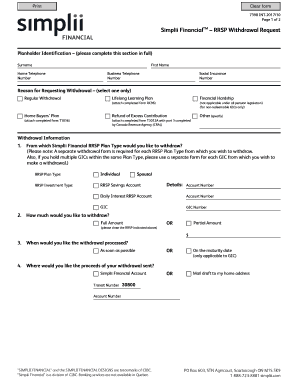

- Begin by filling out your planholder identification information. This includes your surname, first name, home telephone number, business telephone number, and social insurance number. Ensure that all fields are completed accurately.

- Select the reason for requesting the withdrawal. Choose one option from the list provided: Regular Withdrawal, Lifelong Learning Plan, Financial Hardship, Home Buyers’ Plan, Refund of Excess Contribution, or Other. If necessary, attach any relevant completed forms.

- Indicate from which Simplii Financial RRSP Plan Type you wish to withdraw. Remember, a separate withdrawal form is necessary for each plan type and for each GIC if applicable.

- Specify how much you would like to withdraw. You have the option for a full amount, which will close the account indicated, or a partial amount by entering the desired dollar amount.

- Choose when you would like the withdrawal processed. Options include as soon as possible, on the maturity date (only applicable for GIC), or mailed to your home address.

- State where you would like the proceeds of your withdrawal to be sent. Provide details such as your Simplii Financial account's transit number and account number.

- Review the planholder acknowledgment section carefully. Make sure to read through the terms regarding the irrevocability of the request, tax consequences, and withholding tax rates.

- Sign and date the form to acknowledge your request. Your signature indicates that you understand the implications of this withdrawal.

- Finalize your submission by saving changes, downloading a copy for your records, printing, or sharing the form as necessary.

Complete your Simplii RRSP Withdrawal form online today for a seamless withdrawal experience.

To withdraw funds from your RRSPs under the HBP, fill out Form T1036, Home Buyers' Plan (HBP) Request to Withdraw Funds from an RRSP. You have to fill out this form for each withdrawal you make. After filling out Area 1 of Form T1036, give it to your RRSP issuer. The issuer must fill out Area 2.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.