Loading

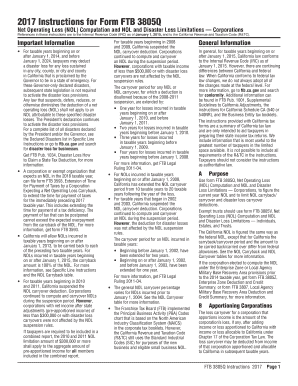

Get 2017 Form 3805q Instructions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2017 Form 3805q Instructions online

This guide provides a comprehensive, step-by-step overview to assist users in successfully completing the 2017 Form 3805q Instructions online. It is designed for individuals with varying levels of experience with legal documents.

Follow the steps to complete your form effectively.

- Click ‘Get Form’ button to access the form and open it in the online editor.

- Begin by reviewing the purpose of the form, which is to compute the current year net operating loss (NOL) and to manage NOL carryback/carryover and disaster loss limitations as stated in the introduction.

- In Part I, input your current year NOL on the appropriate lines. If the corporation incurred a disaster loss, detail this amount on Line 2.

- Proceed to Part II to calculate the NOL carryover and disaster loss carryover limitations. Ensure you separately analyze each type of loss based on its source.

- Move to Part III for NOL carryback options, entering applicable details like the year incurred and types (general, new business, etc.).

- Review the declared disasters list and related codes if claiming a disaster loss. Ensure all entries relate to the current form year.

- Once all sections are complete, save changes to the document. You will have options to download, print, or share the completed form as needed.

Complete your 2017 Form 3805q online today for faster processing and better management of your tax obligations.

In the U.S., a net operating loss can be carried forward indefinitely but are limited to 80 percent of taxable income.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.