Loading

Get Ks P1032 2009-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KS P1032 online

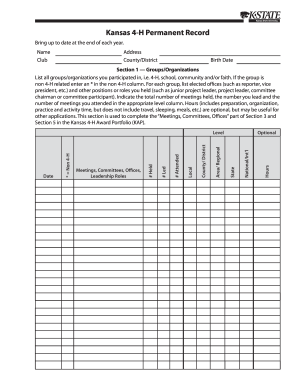

The KS P1032 form is a key document for recording your achievements and experiences in various organizations, particularly in 4-H. This guide will help you navigate each section of the form to ensure accurate and comprehensive completion.

Follow the steps to successfully complete the KS P1032 form online.

- Press the ‘Get Form’ button to access the form and open it in your preferred editing tool.

- Begin by entering your personal information in the designated fields, including your name, club affiliation, address, county or district, and birth date.

- In Section 1 — Groups/Organizations, list all groups or organizations you participated in, including 4-H and non-4-H activities. Use an asterisk (*) to denote non-4-H groups. Include any elected offices or roles you held, and indicate the total number of meetings held, how many you led, and how many you attended.

- Complete Section 2 — Communications/Presentations, Exhibits, Contests by listing all projects completed. Similar to Section 1, mark non-4-H activities with an asterisk (*). Detail the size of the projects, indicate team efforts where applicable, and provide placing for evaluated activities.

- In Section 3 — Activities, document events or activities not captured in other sections. Like previous sections, indicate if the activity was non-4-H with an asterisk (*), and specify whether your involvement was leadership, citizenship, or both.

- For Section 4 — Most Important Recognitions, list notable recognitions received throughout the year, marking non-4-H recognitions with an asterisk (*). Specify the kind of recognition and the date received.

- After completing all sections, review your entries for accuracy. Once satisfied, you can save changes, download, print, or share the form as needed.

Start completing your KS P1032 online today to ensure all your accomplishments are documented.

Filing a Kansas income tax return is necessary if your income exceeds the state's minimum thresholds. Even if you think you're below that threshold, situations can arise that might require filing. For entry and guidance about filing the return, look into the KS P1032 form. It's wise to consult a tax professional if you're uncertain about your situation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.