Loading

Get 2018 Mi 1040es

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2018 Mi 1040es online

Filling out the 2018 Mi 1040es form for estimated income tax can seem daunting, but with clear guidance, you can navigate the process effectively. This guide will provide you with detailed, step-by-step instructions to ensure accurate completion of the form online.

Follow the steps to fill out the 2018 Mi 1040es with ease.

- Click the ‘Get Form’ button to obtain the required document and open it in your preferred editor.

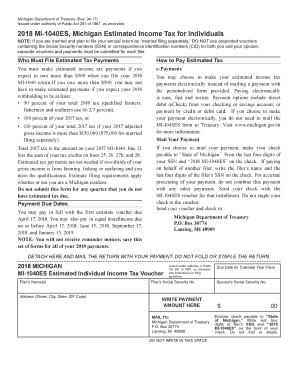

- Begin by filling out the filer’s name and address fields at the top of the form. Ensure that you include your complete address including street, city, state, and ZIP code.

- Enter your Social Security number in the designated field. If you are filing jointly, include your partner’s Social Security number as well.

- In the payment amount section, clearly write the estimated tax payment you are submitting. Ensure that the amount matches your calculations based on your expected tax liability.

- Review the payment due dates and ensure your payment corresponds with the correct installment. You may choose to make a full payment or select the option for equal installments.

- Decide whether you will be making your payment electronically or mailing a check. If mailing, write the check payable to 'State of Michigan' and include the last four digits of your Social Security number along with '2018 MI-1040ES' on the check.

- Once all fields are accurately completed, save your changes. You may choose to download, print, and share the form if necessary, or proceed with your online payment option.

Submit your 2018 Mi 1040es form online to ensure timely processing of your estimated tax payments.

Estimated Tax Payments (MI-1040ES) You may receive estimated payment vouchers in the mail even if you have not filed estimated payments in the past. If you owed the Michigan Department of Treasury over $500 in previous years you may be required to make estimated payments.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.