Loading

Get Form 3840 Instructions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 3840 Instructions online

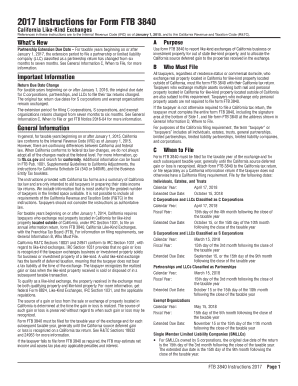

Filling out the Form 3840 Instructions correctly is crucial for reporting like-kind exchanges of California real estate. This guide provides clear, step-by-step instructions tailored to meet the diverse needs of users, ensuring a smooth online filing experience.

Follow the steps to complete the Form 3840 Instructions online.

- Press the ‘Get Form’ button to access the form and open it in the editor.

- Fill in the taxpayer's name, identification number, and address in the designated fields at the top of the form using black or blue ink.

- Indicate the taxpayer's status by checking the appropriate box for individuals, estates, trusts, or business entities in Question A.

- For Question B, check the box that corresponds to the type of form being filed: Initial, Amended, Annual, or Final FTB 3840.

- In Question C, check the relevant boxes to indicate the type of property exchanged and, if applicable, provide information about related parties involved.

- Complete Part I by providing descriptions and relevant dates of the like-kind properties involved in the exchange as specified in the federal instructions.

- Fill out Part II to report the realized gain or loss, recognized gain, and basis of the like-kind properties received.

- For Schedule A, detail the properties given up by listing them, indicating their location and ownership percentage.

- Include selling expenses and California adjusted basis for each property given up as required in the specified fields.

- Submit the completed form by either attaching it to the California tax return or mailing it directly to the Franchise Tax Board if there is no return filed.

Start filling out your documents online today to ensure timely and accurate submissions.

You must report the like-kind exchange on California Like-Kind Exchanges (FTB 3840) if both of the following occur: An exchange of one or more California real properties for one or more real properties located outside of California. Any portion of the California sourced realized gain or loss is not recognized.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.