Loading

Get Rfd 01 Pdf

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Rfd 01 Pdf online

Filling out the Rfd 01 Pdf is an essential step for individuals seeking to apply for tax refunds. This guide will provide you with clear, step-by-step instructions to complete the form online, ensuring that you can efficiently manage your tax refund application.

Follow the steps to complete the Rfd 01 Pdf online.

- Press the ‘Get Form’ button to access the Rfd 01 Pdf and open it in your preferred online editor.

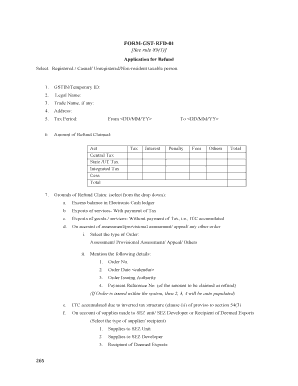

- Begin by entering your GSTIN or Temporary ID in the designated field. This is crucial for verifying your identity as a taxpayer.

- Input your legal name and trade name, if applicable, in the next fields. Make sure these are accurate as they will appear on the official documents.

- Fill in your address details carefully. This information is necessary for correspondence regarding your application.

- Indicate the tax period for which you are claiming the refund by selecting the appropriate dates from the dropdown calendar fields.

- State the total amount of refund claimed. This includes specifying amounts separately for central tax, state/UT tax, integrated tax, cess, and any other fees.

- Select your grounds for refund claim from the dropdown menu. Options include excess balance in an electronic cash ledger or exports of goods/services, among others.

- If applicable, specify the type of order if claiming refund based on assessment. Provide details like order number, date, and issuing authority.

- Fill out the bank account details that are auto-populated if you are a registered taxpayer. This ensures that your refund is directed to the correct bank account.

- Answer whether a self-declaration has been filed under section 54(4), as this is necessary based on the type of refund claim.

- Complete the declarations for various refund claims, ensuring accuracy in your signature, name, and designation/or status.

- Finish by verifying all the details you have entered, ensuring they are true to the best of your knowledge before submission.

- Save your changes, and choose to download, print, or share the completed form as needed.

Take action now by completing your Rfd 01 Pdf online to ensure you receive your tax refund promptly.

Related links form

On the GST portal, select 'Click to fill the details of invoices for inward and outward supplies' Select 'CLICK HERE TO UPLOAD'. Select the file to upload the Statement 1A. Click on 'Download Unique Invoices' to view the uploaded invoices. Select the declaration checkbox and click on 'PROCEED'.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.