Loading

Get State, Local, And District Consumer Use Tax Return. Cdtfa-401-e

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the State, Local, And District Consumer Use Tax Return. CDTFA-401-E online

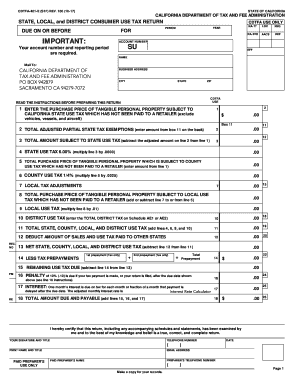

Filling out the State, Local, And District Consumer Use Tax Return (CDTFA-401-E) online is an essential task for individuals and businesses that need to report their use tax obligations in California. This guide provides a clear and structured approach to help you complete the form accurately and efficiently.

Follow the steps to complete the CDTFA-401-E form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your account number and reporting period in the designated fields. Ensure these details are correct to avoid processing delays.

- Fill in your name and business address, including city, state, and zip code. Accurate contact information is crucial for any follow-up communications.

- Line 1: Input the total purchase price of tangible personal property that is subject to California state use tax but has not been paid to a retailer.

- Line 2: If applicable, complete the adjusted partial state tax exemptions found on the back section of the form and enter the total exemption amount here.

- Line 3: Calculate the total amount subject to state use tax by subtracting the amount from line 2 from line 1. Enter this value in the field.

- Line 4: Multiply the amount on line 3 by 6.00% to determine your state use tax. Enter this value.

- Line 6: If there are county use taxes applicable, multiply the appropriate amount from line 5 by 0.25% and enter it on this line.

- Line 8: Total the purchase price of tangible personal property subject to local use tax. Modify this amount based on local tax adjustments as needed.

- Line 11: Add together lines 4, 6, 9, and 10 to find the total state, county, local, and district use tax and enter this on line 11.

- Line 12: If you have paid sales and use tax in other states, enter that amount here to deduct it from your total.

- Line 13: Subtract the amount on line 12 from line 11 to find your net use tax due.

- Complete lines for prepayments if applicable, followed by the remaining use tax due. Ensure to calculate any penalties or interest if applicable.

- Lastly, review the form for completeness and accuracy, then save changes or print for your records. Ensure you have signed and dated the form.

Complete your CDTFA-401-E form online today to ensure compliance with California tax regulations.

District taxes are voter-approved transactions (sales) and use taxes imposed by certain cities, counties, and other government entities. District taxes are not imposed in all areas of California. District tax rates vary between districts.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.