Loading

Get 3805z 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 3805z 2017 online

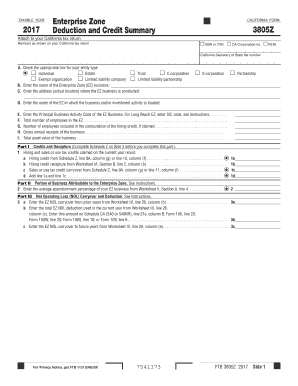

The 3805z 2017 form is essential for claiming Enterprise Zone deductions and credits in California. This guide provides clear and structured instructions for completing the form online, ensuring that users can navigate each section with confidence.

Follow the steps to successfully complete your 3805z 2017 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) along with any corporate identification numbers as needed.

- Identify the entity type by checking the appropriate box. Choose from options like Individual, Estate, Trust, C Corporation, S Corporation, Partnership, Exempt Organization, Limited Liability Company, or Limited Liability Partnership.

- Provide the name of the Enterprise Zone business in the designated field.

- Fill out the actual location address where the Enterprise Zone business operations take place.

- Record the name of the specific Enterprise Zone in which your business is located.

- Enter the Principal Business Activity Code of the Enterprise Zone business as required.

- Indicate the total number of employees working in the Enterprise Zone.

- If applicable, specify the number of employees for whom the hiring credit is claimed.

- Fill in the gross annual receipts of your business.

- Enter the total asset value of the business.

- Complete Schedule Z on Side 2 prior to this section for credits and recapture.

- Proceed to complete the credit limitations as well as any net operating loss (NOL) details if applicable.

- Review the entire filled form for accuracy, then save changes, download, print, or share the completed document as needed.

Start filling out your 3805z 2017 form online today to take advantage of available deductions and credits.

Related links form

Established by the California Trade & Commerce Agency in 1984, the Enterprise Zone Program is a tax saving incentive designed to stimulate growth and development in selected areas within California. This program promotes the creation of new jobs, attracts new businesses, and retains businesses in particular areas.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.