Loading

Get Ca F-322 R4 2011-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA F-322 R4 online

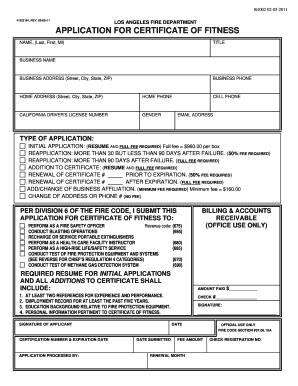

Filling out the CA F-322 R4 form is essential for individuals seeking a certificate of fitness required by the Los Angeles Fire Department. This guide provides a clear and structured approach to completing the online application process, ensuring that users can navigate each section with confidence.

Follow the steps to successfully complete your application.

- Click ‘Get Form’ button to access the application and open it in the editor.

- Enter your name in the format of last name, first name, and middle initial in the designated field.

- Fill in your title and business name as applicable. Ensure that all entries are accurate and complete.

- Provide your business address, including street, city, state, and ZIP code, as well as your business phone number.

- Complete your home address and home phone number to ensure proper communication.

- Input your California driver’s license number and gender in the relevant fields.

- Add your cell phone number and email address to the application to facilitate contact.

- Choose the type of application you are submitting. Options include initial application, reapplication, addition to certificate, and renewal. Each type has different fee requirements.

- If this is an initial application or an addition to your certificate, ensure you attach the required resume and any documentation specified.

- List at least two references for experience, your employment record for the past five years, and any relevant education background.

- Indicate the amount you are paying for the application in the designated field.

- Review all information for accuracy, then provide your signature and date to certify the application.

- Once completed, you can save changes, download, print, or share the form as necessary.

Complete your CA F-322 R4 application online today for a smooth and effective process.

Any fiduciary overseeing a trust or estate that has generated taxable income in California must file a fiduciary income tax return. This is especially important if the trust or estate has an income exceeding $600, as delineated in the CA F-322 R4. Proper filing ensures compliance with California tax laws.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.