Loading

Get You Are Required To Submit This Return And Pay The Tax Pursuant To Sonoma County Ordinances 5823

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the You Are Required To Submit This Return And Pay The Tax Pursuant To Sonoma County Ordinances 5823 online

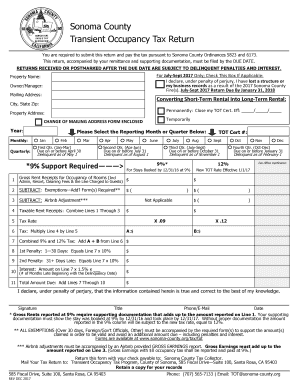

Filling out the You Are Required To Submit This Return And Pay The Tax Pursuant To Sonoma County Ordinances 5823 form is an essential task for users managing transient occupancy taxes in Sonoma County. This guide provides clear, step-by-step instructions to assist you in completing the form accurately and efficiently online.

Follow the steps to complete the tax return online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the property name and the owner or manager's name in the designated fields.

- Fill in your mailing address along with the city, state, and zip code.

- Indicate if you are converting a short-term rental into a long-term rental by checking the appropriate box and providing effective dates if applicable.

- Select the appropriate reporting month or quarter from the options provided for your tax return.

- Fill in the gross rent receipts for occupancy of rooms, ensuring to include all relevant fees charged to guests.

- Subtract any exemptions applicable to your situation in the next section, making sure to attach additional forms if required.

- Complete the Airbnb adjustment section if applicable, as this also requires supporting documentation.

- Calculate your taxable rent receipts by combining the amounts from the previous lines.

- Determine the tax rate and multiply it by your taxable rent receipts to find the total tax owed.

- Include any penalties or interest due for late submissions, following the instructions provided.

- Finally, add together all amounts due to find the total amount to be submitted.

- Review your completed form for accuracy and make any necessary corrections.

- Once complete, you can save changes, download, print, or share the form as required.

Ensure you complete your tax return online to avoid any potential penalties.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

7.25% California state sales tax. 1.25% Sonoma County local (voter enacted) sales taxes.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.