Loading

Get Loan Application, Including Promissory Note, Deduction Authorization, And Loan Rules Disclosure

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Loan Application, Including Promissory Note, Deduction Authorization, and Loan Rules Disclosure online

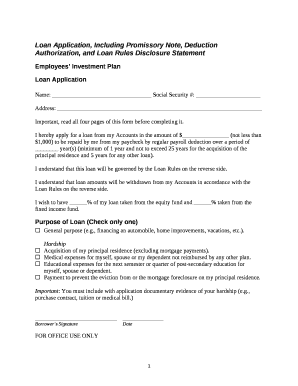

Completing the loan application, including the promissory note, deduction authorization, and loan rules disclosure, is an essential step in securing funding. This comprehensive guide will walk you through each section of the form to ensure you understand the process and provide the necessary information with confidence.

Follow the steps to successfully complete your loan application online.

- Click the ‘Get Form’ button to access the loan application. This will open the form in your editing interface.

- Begin by entering your name and Social Security number in the designated fields. Ensure that your information is accurate to prevent any processing delays.

- Fill in your address completely. This is important for verification and communication regarding your loan application.

- Specify the loan amount you are applying for. Remember that the minimum amount is $1,000.

- Indicate the repayment period for the loan. You can choose a term from a minimum of one year up to a maximum of twenty-five years for a principal residence loan or five years for other loans.

- In the purpose of the loan section, check only one box that reflects your reason for borrowing. Be prepared to provide supporting documentation for hardship loans.

- Sign the application as the borrower and enter the date. If applicable, your partner should also sign and date the form.

- Once you have filled out the application, review all entries to ensure accuracy before submitting.

- After submission, follow any specific instructions for your plan administrator regarding loan approval. Keep a copy of your completed form for your records.

- Finally, save your changes and download or print your application if you need a physical copy, or opt to share it if required.

Complete your loan application online today and take the first step towards securing your funding.

Who qualifies for student loan forgiveness? To be eligible for forgiveness, you must have federal student loans and earn less than $125,000 annually (or $250,000 per household). Borrowers who meet that criteria can get up to $10,000 in debt cancellation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.