Loading

Get Form 3523 Instructions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Form 3523 Instructions online

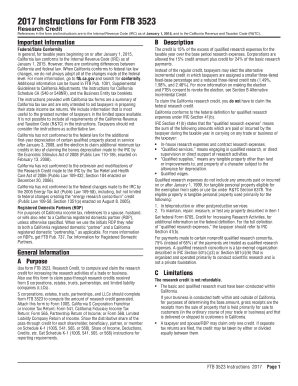

The Form 3523 Instructions guide taxpayers through the process of claiming the research credit for increasing research activities of a trade or business in California. This guide provides a comprehensive overview and step-by-step instructions tailored to assist all users, regardless of their legal knowledge.

Follow the steps to effectively fill out the Form 3523 Instructions online.

- Click the ‘Get Form’ button to obtain the form and access it in the editor.

- Review the purpose of Form FTB 3523, which is to compute and claim the research credit, and understand the eligibility requirements.

- Read through the General Information section to be aware of limitations, including eligibility based on business activities conducted within California.

- Proceed to Part I to compute the credit: complete lines for qualified research expenses and enter applicable credit amounts, ensuring that entries do not exceed specified limits.

- If applicable, fill out Section B for the Alternative Incremental Credit by making the necessary election to ensure compliance with the requirements.

- Visit Sections C and D to address credit allocation and carryovers, ensuring accurate reporting of any assigned credits and understanding how carryovers apply.

- Double-check all entries for accuracy, ensuring that the amounts and calculations align with the guidelines provided in the instructions.

- Once satisfied with your input, save your changes, and utilize the options to download, print, or share the filled-out form as needed.

Start completing your Form 3523 Instructions online today to streamline your tax credit process.

Related links form

$5 million is the maximum amount each taxpayer can get back in business tax credits in California, including the R&D tax credit for taxable years beginning on or after January 1, 2020, and before January 1, 2023.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.