Loading

Get W2 Template

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the W2 Template online

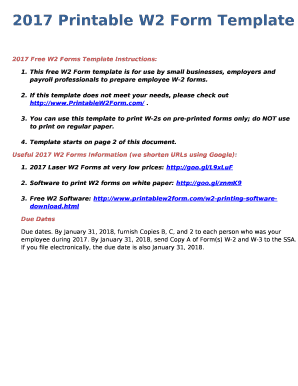

Filling out the W2 Template online can be a straightforward process when you understand the components of the form. This guide will help you navigate each section and ensure that you complete the form accurately and efficiently.

Follow the steps to complete your W2 Template with ease.

- Click 'Get Form' button to acquire the template and access it in your preferred editing tool.

- Begin by filling in the employer's details, including the name, address, and Employer Identification Number (EIN). This information should reflect your business accurately.

- Next, enter the employee's information. Include their full name, address, and Social Security Number (SSN). Ensure that all details are correct to avoid issues with tax filings.

- In the following sections, fill out the financial information for the employee, including wages, tips, and other compensation in Box 1. Be thorough to ensure that all earnings are accounted for.

- Complete Boxes 2 through 6, which detail federal income tax withheld, Social Security wages and tax, Medicare wages and tax, and any other applicable details.

- Finalize by reviewing all entered information for accuracy. Once confirmed, you can save the document, download it in the desired format, print it for distribution, or share it as needed.

Start completing your W2 Template online today to ensure timely and accurate filing!

Not necessarily; and in fact it probably shouldn't, for data security reasons. However, the actual Control Number assigned for your W-2 in any given year is up to the discretion of your employer's payroll department or payroll outsourcing firm.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.