Loading

Get A Taxpayers Guide

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the A Taxpayer's Guide online

This guide provides a clear, step-by-step approach to filling out the A Taxpayer's Guide form online. Whether you are familiar with tax documents or not, this guide will help you navigate through the various sections with ease.

Follow the steps to successfully complete the A Taxpayer's Guide.

- Click 'Get Form' button to obtain the form and open it in your chosen editor. This initiates the process of filling out the A Taxpayer's Guide.

- Begin by entering the date at the top of the form. This helps in keeping a record of when the form was completed.

- Fill in the 'Donated To' section with the name of the organization that received your contributions.

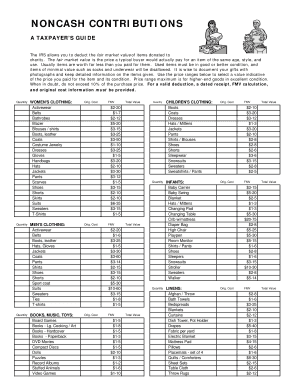

- In the 'Quantity' column, enter the number of each item donated. Be specific and list each category according to the provided sections such as women’s clothing, men’s clothing, etc.

- Next, fill in the 'Original Cost' of each item in the respective section. Refer to your purchase records if necessary.

- Estimate the Fair Market Value (FMV) for each item based on the guidelines within the form. Use the provided price ranges to assist you.

- Calculate the total value for each section by summing the FMV of the items listed.

- Review all the entries to ensure the details are correct and complete, making any necessary adjustments.

- Once you are satisfied with your entries, you can save your changes, download a copy, print the completed form, or share it as needed.

Complete your documents online today and ensure your contributions are properly documented for tax purposes.

File returns and pay taxes on time. Provide accurate information on tax returns. Substantiate claims for refund. Pay all taxes on time after closing a business, and request cancellation of the tax account.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.