Loading

Get Loan Escrow Intake Sheet (refinance)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

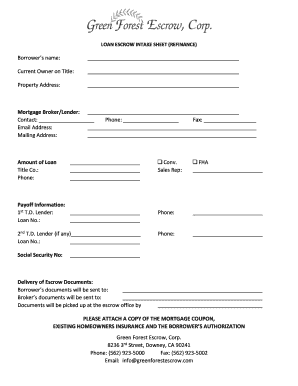

How to fill out the LOAN ESCROW INTAKE SHEET (REFINANCE) online

Filling out the loan escrow intake sheet for a refinance can seem daunting, but this guide will provide you with clear and systematic instructions. By following each step, you can efficiently complete the form online, ensuring all necessary information is accurately submitted.

Follow the steps to successfully complete the loan escrow intake sheet online.

- Press the ‘Get Form’ button to access the form and open it in your preferred online editor.

- Begin by entering the borrower's name in the designated field. Ensure that the name is spelled correctly, as it appears on official documents.

- In the section labeled 'Current Owner on Title,' input the name of the person or entity currently listed on the property title.

- Provide the property address, making sure to include the street number, street name, city, state, and zip code.

- Fill in the mortgage broker or lender's information, including their name, contact person, phone number, fax number, email address, and mailing address. This is crucial for correspondence.

- Enter the loan amount you are applying for, along with the title company’s name and phone number.

- Under 'Payoff Information,' list the name of your first trust deed lender and the corresponding loan number. If applicable, also provide information for a second trust deed lender.

- If required, input your Social Security Number for identity verification. Ensure to keep this information secure.

- Indicate the loan type such as conventional or FHA, and provide the associated sales representative's name and contact information.

- Specify how you would like to receive the escrow documents by detailing the address for the borrower's documents and the broker’s documents.

- Identify who will pick up the documents at the escrow office by writing their name in the appropriate field.

- Don’t forget to attach a copy of the mortgage coupon, existing homeowners insurance, and the borrower’s authorization as indicated.

- Finally, review the entire form for accuracy before proceeding to save your changes, download, print, or share the completed form as needed.

Start completing your loan escrow intake sheet online now to ensure a smooth refinancing process.

Escrow Fee – these vary by escrow company and they are based on the loan amount. Usually between $500 – $1000. Title Insurance Premium – this is for a lender's title policy. Rates are based on loan amount.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.