Loading

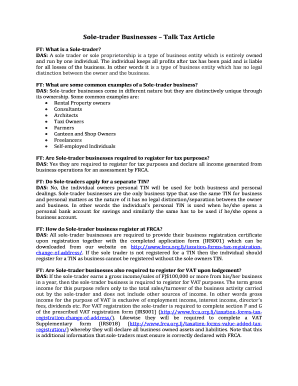

Get Sole-trader Businesses Talk Tax Article

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sole-trader Businesses Talk Tax Article online

This guide provides step-by-step instructions for completing the Sole-trader Businesses Talk Tax Article form online. Whether you are new to tax documentation or familiar with the process, this resource is designed to assist you in accurately filling out the required information.

Follow the steps to successfully complete your form.

- Click the ‘Get Form’ button to download the Sole-trader Businesses Talk Tax Article form and open it in your preferred document editor.

- Begin with Section A, where you will need to provide your personal details, including your name, contact information, and personal Tax Identification Number (TIN). Ensure that your TIN matches your bank account and personal identification.

- In Section B, indicate the nature of your business. Common examples include rental property ownership, consultancy, and self-employment. You should select the option that best describes your business activities.

- Proceed to Section C, where you will declare your projected gross income for the year. If you anticipate earning FJ$100,000 or more, remember that you will need to register for VAT.

- If you are employing others, complete Section D by including all relevant details about your employees. This includes their names, TINs, and the position they hold within your business.

- In Section E, you’ll confirm your registration for TIN and note if you will be submitting Employer Monthly Summaries (EMS) related to your employees’ PAYE deductions.

- Fill out Section F and G to provide additional information for VAT registration if applicable, including details of any business assets and liabilities.

- Once all sections are completed, review your entries to ensure accuracy. Save the changes made to the form before proceeding.

- Finally, download, print, or share the completed form as required for submission to the relevant tax authority.

Complete your Sole-trader Businesses Talk Tax Article form online to ensure compliance and avoid penalties.

The difference between self-employed and sole trader is that “Self-employed” is only a label. This means that you are not employed by another company or person and that you do not pay tax through PAYE. A sole trader is a self-employed worker and is the sole owner of their business.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.