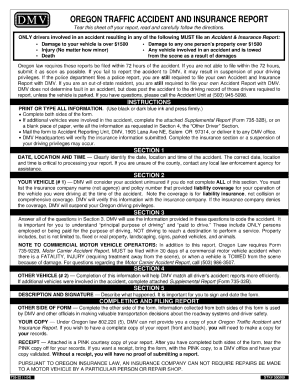

Loading

Get Or 735-32 2004

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the OR 735-32 online

Filling out the OR 735-32 form online can streamline your document management process. This guide provides a clear and step-by-step approach to ensure you complete the form accurately and efficiently.

Follow the steps to fill out the OR 735-32 form online

- Press the ‘Get Form’ button to obtain the OR 735-32 document and open it in the editor.

- Once the form is open, begin by filling in your personal information in the designated fields. Ensure that you provide accurate details such as your name, address, and contact information.

- Proceed to the section that requires specific information related to the purpose of the form. Carefully read the instructions and provide the necessary details as prompted.

- Review the sections that require additional documentation or attachments. Make sure to prepare and include any documents that support your application, if applicable.

- When you are satisfied with the information provided, you can save your changes, download a copy for your records, or print the form directly from the editor.

Take the next step in your digital document management by completing the OR 735-32 form online today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Claiming insurance when the accident is not your fault follows a structured process. First, report the incident to your insurance provider, including all pertinent details and evidence. Depending on OR 735-32, your insurance will handle communication with the at-fault party's insurer. Using platforms like uslegalforms can help expedite the process by providing templates for necessary documents, ensuring you receive a fair settlement.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.